Financial Management: Do you know your numbers?

One of the most important things a business owner should know, is “their numbers”. Do you know how well your business is performing and in which areas? Do you know who you owe and who owes you? Can you afford to make upcoming payments and meet your financial obligations?

The importance of up to date, accurate numbers

Up to date, accurate numbers, starts with data processing, bookkeeping. Whether you are doing your own bookkeeping, or you have someone who looks after that for you, it needs to be done regularly and it needs to be done right.

Bookkeeping is the cornerstone to all your numbers, so here are my top tips:

Use bookkeeping software for error reduction: with manual bookkeeping it is too easy to mis type or key the wrong number into a calculator, and not realise. Bookkeeping software has lots of time saving functionalities, you can read more about it in our Bookkeeping for Business Owner blog.

Training: With a little training, you will be able to use the software much more efficiently. It is important to get it right first time and not just push transactions through. This can lead to expensive unpicking, potentially inaccurate management information or even incorrect numbers being filed in a tax return!

Outsourcing: It often adds more value than it costs to outsource your bookkeeping to a specialist bookkeeper or your Accountant. This allows you to focus on growing your business.

With up to date, accurate numbers in your bookkeeping software you will be able to:

- Run customer statements, collecting in money owed to you faster

- Understand what you owe to suppliers and when payments are due

- Run inciteful reports that show you how you are performing

Two of the main reports that are run for businesses are the Profit and Loss account and the Balance Sheet. So, what are they?

The Profit and Loss Account

A financial statement summarising the businesses income and expenses over a period of time, often a financial year. It can also be referred to as a trading statement, or an income statement too.

As it shows whether a business has made a profit or loss, it is a key tool for assessing how well a company is performing.

Typically, it uses the dates on your transactions, so invoice dates and the date on your bill or receipt for expenses. Although in some circumstances, it is the receipt or payment date that is used(cash accounting).

If your transactions are up to date in your bookkeeping software, you can run this report and see how well your business is performing:

- Month on month

- Year to date

- As compared by the same period last year

Take care if your numbers haven’t been looked at by your Accountant, as there are adjustments that get made to the raw numbers at the yearend (sometimes more often) to ensure that all the costs and revenues in the period, relate to that period.

Stock: If you are buying and selling things, let’s say tins of beans, then you will most likely have to buy these items in bulk, and are unlikely to buy and sell the same items in the same day. So, you will end up holding stock. Stock, in this example, is the value of the tins of beans that you purchased during the reporting period but have not yet sold(by the last date of your reporting period).

Work in Progress: The value of an unfinished project that has costs going through the accounts for materials and labour, but has not yet been invoiced.

Accruals and prepayments: this is a similar principle to stock but is used where you know you have a liability(something you are going to have to pay), but the bill for the expense hasn’t arrived as yet (perhaps rent), or where a bill covers a period of time that is not fully within the reporting period (things like insurances and council tax).

Depreciation: If you have purchased items of a capital nature, these are classed as assets and coded to a balance sheet account, rather than a profit and loss account, as the accounting rules on how to treat these are different to revenue spend items. Depreciation is calculated (largely splitting the cost over its deemed useful life (0ften 5 years or more)) and charged to the profit and loss account as a cost over that period of time.

Taxable Profit: When pulling together your year-end accounts, your Accountant will take account of Stock, and WIP and accruals etc. They will also adjust for any business expenses which are not tax deductible. So, you can end up with a taxable profit which is significantly different to the profit on your profit and loss account. Your accountant should talk you through this at your year-end meeting

Adjustments will be made for things like:

- Personal use

- Client entertainment

- Depreciation, which will be substituted for capital allowances and the annual investment allowance for capital purchases

The Balance Sheet

This gives a snapshot of the company at a particular date, typically the last day of the financial year. It shows the assets, liabilities and equity in the business.

It shows what your business owns, what it is owed and what it owes at a point in time.

Assets: these are things that the business owns and they fall into the categories below:

- Fixed Assets (also known as Tangible Assets): things that will not be fully consumed during the financial year. Also known as Capital Purchases, they are usually things you can touch and see.

The original cost of the asset is posted to the balance sheet, and then reduced, over its useful life using something called depreciation. The value on the balance sheet, after depreciation, should be a fair approximation of its market value, although this isn’t always the case.

This depreciation amount is charged to the profit and loss account, often calculated annually by your Accountant.

Categories of Fixed Assets include: Buildings, Plant and Equipment, Furniture and Fittings.

- Current Assets: short term assets that the business owns. Deemed as easily convertible to cash. Deposits in business bank accounts, Accounts receivable (Debtors) – amounts you have invoiced to customers/clients, but have not yet been paid, and Stock/inventory.

Liabilities: amounts the business owes.

Current Liabilities: Short term obligations:

- Accounts payable (Creditors) – amounts owed to your suppliers

- Pensions – amounts owed to the pension fund and not yet paid

- PAYE – taxes and NI deducted and not yet paid, plus employers’ national insurance not yet paid

- VAT – not yet paid over to HMRC

- Corporation Tax – not yet paid

Longer term liabilities (greater than one year): Creditors:

- Loans and mortgages (generally split between short and longer term liabilities sections)

- Directors Loans – these can be assets or liabilities depending on whether the Directors owe the business money, or the business owes money to them.

The Equity Section

This section equals the same amount as the Assets less the Liabilities from above. This is what is referred to as the balance sheet balances. With computerised bookkeeping, the balance sheet will always balance if the software is operated correctly.

It represents the shareholders stake in the company.

- Share capital – the nominal value of the shares in circulations. If more than the nominal value has been paid for any shares, then the difference to the nominal value is posted into a share premium account in this section)

- Profit and Loss Account (or retained profit) – profits from previous years, not distributed as dividends

- Profit and loss for the current year.

Cash Flow

Cash is a great facilitator, and is needed to run a business, and needed even more, to grow a business. Cash is King!

So, it is imperative that, as business owners, we understand our cash flow.

Cashflow differs from profit in two ways:

- Timing of things that appear on the profit and loss account:

- The date we raise an invoice is the tax point and when it is recognised in the profit and loss account. But this invoice may not be paid for many weeks

- Bills we receive may be due for payment at the end of the month

- Things that never appear in a profit and loss account:

- VAT is charged and suffered on many transactions, as they are processed, but is only paid either monthly or quarterly and the deadline is 5 weeks after the end of the reference period

- Corporation Tax is paid 9 months after the financial year end

- PAYE deductions and are due by the 22nd of the following month

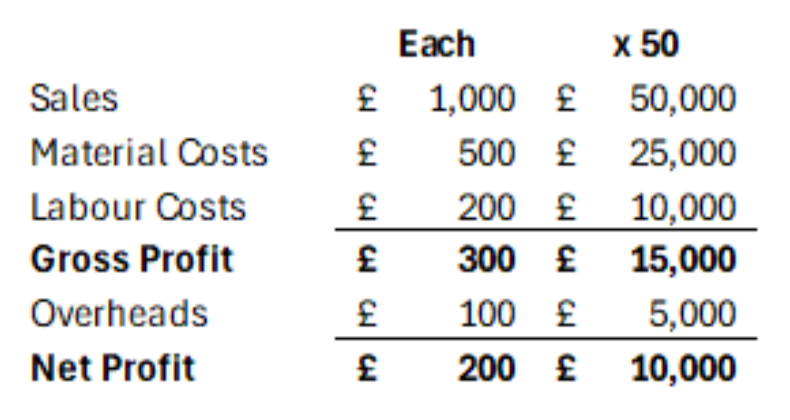

Let’s look at an example, to help us explain how cash flow differs from profit and why. We will look at a simple manufacturing business who makes widgets and sells them for £1,000 each.

In the reporting period, the profit declared is £10,000, but what does this mean from a cash perspective?

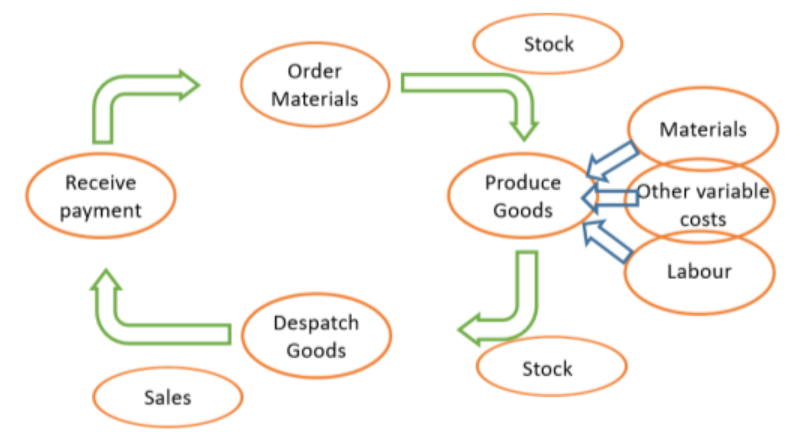

The process flow is illustrated in the below diagram.

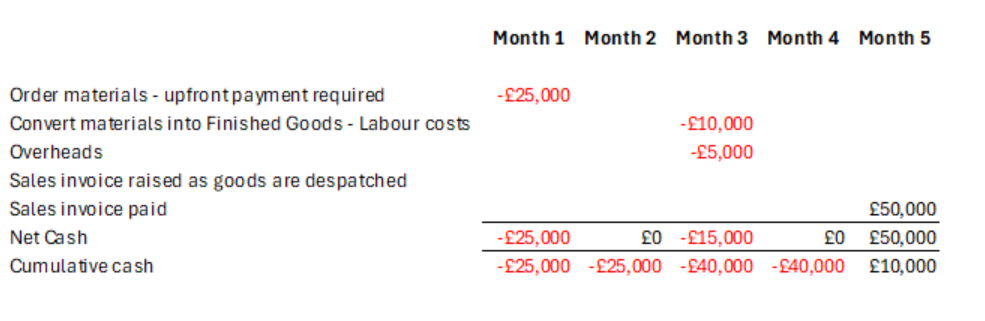

Cashflows are shown below.

We can see from this example that we need to access cash from somewhere to facilitate the sales, and this is not an uncommon example. With service-based businesses, this effect is not as pronounced, but you still need to pay for offices and travel and wages etc before you get paid in most business models.

Future Cashflow liabilities

It is really important that we understand our future cash flow liabilities so that:

- We don’t run out of cash – it can take weeks to organise funding

- We don’t spend cash that is in the bank now, but should be earmarked for these future liabilities

Financial Planning

A budget or forecast are financial tools that help businesses plan for the future. The two terms are often interchanged, but fundamentally, a Budget is a more formal long-term plan and a forecast tends to be shorter term and more flexible, often taking into account changes that become known during a financial period.

When pulling together your budget, it is important to appreciate that, whilst we don’t have a crystal ball, we do have a good idea of some revenues and expenses and we can use history to predict the future. For new start businesses, and for those things that are harder to predict with certainty, we should use a set of assumptions.

It’s a really good idea to do scenario analysis with your numbers when you are pulling plans together. What would happen if we won that big new contract, or moved premises etc. Anything that is possible is worth planning for.

Resource planning: One of the most valuable aspects of financial planning is resource planning.

Some of the things to consider are:

- Cash: Our cash flow forecast will highlight if we need to look at funding. It can take several weeks to research and secure the right funding for your business. Funders will need some key information, so it’s important to have a cashflow forecast that shows you:

- How much you need

- For how long

- What you plan to spend it on

- Prove your ability to afford the repayments and interest

- Staffing: if we are planning to grow the business, the chances are we will need to bring in additional people. This takes time, so we should plan to ensure we have the necessary resources in role and trained for when we need them. We will need to;

- Job spec

- Advertise

- Interview

- Notice period

- Training

- Raw Materials: Some raw materials can have long lead times and this needs to be factored in. Plus, we need to ensure we have enough stock to convert and sell without running out.

- Marketing: if we are planning to grow and marketing is going to be key to this growth, then we need to build in time to:

- Build a marketing strategy

- Put it into practice

- Allow for a lead time, depending on the route to market

Financial Reporting and KPI’s

Once we have a financial plan, with Budget or Forecast numbers, we can monitor performance against it throughout the year. Deviations from the budget are often early warnings and the management team can put further plans in place to address them.

As well as profit and loss, balance sheet and cash flow budgets, you may also want to build a set of Key Performance Indicators (KPI’s) pertinent to your business, with targets for you and your team to measure against.

KPI’s should be measurable and relevant to your business and can then demonstrate how your business is performing against its key business objectives.

KPI’s are used to measure many aspects of a business’s performance and as a management team, you should choose KPI’s that focus on the areas that are important to you. Key stakeholders may also use KPI’s to assess your business.

You are looking for between four and ten KPI’s with a strong focus on the word KEY. These should be carefully chosen as the ones that indicate how YOUR business is performing against its targets and objectives.

Examples of KPI’s

Financial

- Revenue growth: Generally expressed as a percentage. Either month on month or annual

- Revenue per client: Having less clients with more revenue per client can reduce complexity and drive up overall margin. But equally, you may want to have many clients with a relatively small revenue per client so that you don’t have too many eggs in one basket

- Profit margin: Gross and or net profit.

- Liquidity: Also known as the current ratio, this is the current assets divided by current liabilities and measures how well a company manages its short-term debt obligations

- Solvency: How well a company will be able to pay its long term debt. For example, total debt to total assets as a ratio.

Customer focused

- Client retention rate: Attracting and winning new clients can be a costly process, so keeping clients for longer is often great for margin, and also suggests you are doing everything that they need you to do and represent good value.

- Customer Satisfaction: Possibly via a feedback form

- Conversion rate: Attracting new clients can be costly and time consuming, so how many of the clients you speak to do you win? Or click through rates if using online selling tools.

- Customer acquisition cost: Taking into account any costs associated with taking on a new client, using say pay per click and conversion rate.

Operational

- Percentage waste levels

- Returns

- Accidents if you have a manufacturing or warehouse setting.

There are hundreds of different KPI’s, and you need to look at what drives your business objectives and set yours up in relation to those.

Knowing your numbers can have a huge impact on the success of your business, so it is well worth putting the effort in, to have the best quality information on which to make business decisions as you can.

Business Basics - Forecasting

Although we don’t have a crystal ball, so forecasts are fundamentally informed guesses, businesses need to use them to make informed business decisions and develop business strategies.

Profitability

Profit is a measure of a business’s income relative to its expenses. In other words, an organisation’s ability to generate revenue by using resources that it has available, such as people, materials and equipment. Unless you are running a charitable organisation, profit is generally the primary goal of a company. As well as providing income for the owners of a business, profits allow for investment and growth. Whilst revenue growth is generally a positive indicator, we need to understand profitability if a business is to be successful.

Business Essentials: What is a Tax Deductible Expense?

As a business owner, it can be daunting when you are trying to work out what you can and can’t claim as tax deductible expense. Other business owners will give you their opinion but is that the right advice for you and your business? You can search online, but this can be confusing and often contradictory. So, what can you claim?

Financial Management – Do you know your numbers?

One of the most important things a business owner should know, is “their numbers”. Do you know how well your business is performing and in which areas? Do you know who you owe and who owes you? Can you afford to make upcoming payments and meet your financial obligations?

Bookkeeping for Business Owners

Business owners often handle their own bookkeeping when they first start out, as they are time-rich but money poor. However, bookkeeping isn’t a skill you acquire simply by registering a business. But with a robust process, great software, a little training, and someone to call when you’re unsure, it is possible to do this well, even as a novice.

Pricing for Maximum Profit

Are you charging enough for your products or services to allow you to provide a service you are proud of and that allows you to not become a busy fool? Are you confident that you are charging the correct price for your goods or services?

Navigating the Latest Budget: A Survival Guide for Small to Medium Businesses

The Budget announced on October 30th will bring substantial changes for many organisations, resulting in increased costs. So, how can we navigate these changes and still maintain profitable businesses?

The importance of having a robust debt collection strategy for your business

Efficient debt collection is a key driver for growth in a business and a fundamental part of operating with healthy cash flows. It’s because, without the cash available when it’s needed to run the business day-to-day, there’s a risk of falling into financial decline.

What are the finance options for a struggling company?

Running a struggling company in financial difficulty is certainly challenging. However, with so many different finance options now available that don’t involve the high street banks, be reassured that you can quickly secure the cash injection you need and get back on track.

How to write a good business plan

Organisations such as the Start-Up Loan Company...

Peer to peer lending Q&A

Looking for an alternative route to financing your business? Peer to peer (P2P) lending is one of the options.

How digital tax will benefit your business

You will probably have heard about digital tax but what does it actually mean for you and how will it benefit your business?