Coronavirus sector support information and advice is available here for a range of organisation types. If your area is not covered or you need additional support, just get in touch.

This page was last updated in May 2023. Please check the latest national guidance.

Sectors

Guidance about working safely was issued by the government. Further Coronavirus sector support can be found at the following places:

Make UK

MakeUK offer a range of resources, template letters and toolkits for manufacturing businesses, as well as set of Coronavirus-related FAQs.

Manufacturing Growth Programme

The Manufacturing Growth Fund developed a range of resources and guidance for SME manufacturers.

Apprentices

The Department for Education’s guidance for schools and educational settings offered helpful advice.

Digital & Creative

Guidance about working safely was issued by the government. Your business may operate more than one type of workplace, therefore it is important that you refer to all of the relevant publications.

Culture Recovery Fund: Emergency Resource Support

Arts Council England launched a new fund for organisations at imminent risk of failure, particular those who had not yet received grants from the Culture Recovery Fund, to provide Coronavirus sector support until the end of the 2020.

Guidance about working safely was issued by the government. Specific Coronavirus sector support for the retail and hospitality industry included:

VAT reduction for hospitality, accommodation and attractions

Some businesses were eligible for a 5% reduced rate of VAT until 30 September 2021 if their business is in the hospitality, hotel or holiday accommodation sector. From 1 October 2021 to 31 March 2022, the reduced rate of 12.5% will apply. Find out if your business was eligible for VAT reduction.

Additional Restrictions Grant

The Additional Restrictions Grant grant was offered to business who were negatively affected by coronavirus. Examples of what made a business eligible were:

- you do not pay business rates and your business was closed by law;

- you supply an industry that had to close because of coronavirus, for example the retail, hospitality or leisure sector;

- your business is in the events sector.

The Additional Restrictions Grant ended on 31 March 2022.

Find out more about the coronavirus Additional Restrictions Grant.

Business rates holiday for retail, hospitality and leisure

If you were eligible, you:

- may not have needed to pay any business rate for the 2020 to 2021 tax year (1 April 2020 to 31 March 2021);

- may not have needed to pay any business rate for the first 3 months of the 2021 to 2022 tax year (1 April 2021 to 30 June 2021);

- may have received 66% off your business rates bills for the rest of the 2021 to 2022 tax year (1 July 2021 to 31 March 2022) – up to a total value of £2 million.

You would receive:

- up to £2m if your business was required to close on 5 January 2021;

- up to £105,000 if your business was permitted to open on 5 January 2021.

You were eligible if your property was a:

- shop;

- restaurant, café, bar or pub;

- cinema or live music venue;

- leisure or assembly property – for example, a sports club, a gym or a spa;

- hospitality property – for example, a hotel, a guest house or self-catering accommodation.

ADHB

The ADHB offered a dedicated Coronavirus hub that included FAQs, articles and sector specific advice.

Build UK

Build UK produced a directory containing sector-specific advice and information.

The government pledged £750 million to ensure VCSE can continue their vital work supporting the country during the coronavirus (COVID-19) outbreak, including £200 million for the Coronavirus Community Support Fund, along with an additional £150 million from dormant bank and building society accounts.

Articles

Yorkshire businesses get £2.4m digital innovation boost

Hundreds of manufacturing businesses across Yorkshire have put themselves at the forefront of enhancing their business through digital innovation – and now more can join them after a further £2.4m was received to support the region’s digital ambitions. Since 2021, the “Made Smarter Yorkshire and Humber” programme has supported more than 700 Yorkshire manufacturing businesses to take up digital adoption projects to improve efficiency and productivity, boosting the strength of manufacturing across the region.

Profitability

Profit is a measure of a business’s income relative to its expenses. In other words, an organisation’s ability to generate revenue by using resources that it has available, such as people, materials and equipment. Unless you are running a charitable organisation, profit is generally the primary goal of a company. As well as providing income for the owners of a business, profits allow for investment and growth. Whilst revenue growth is generally a positive indicator, we need to understand profitability if a business is to be successful.

BOOST: A marketing support programme for York and North Yorkshire tourism and hospitality businesses

This practical, action-oriented programme of activity has been developed to help you market your business more effectively, saving time and money. It’s created and delivered by Susan Briggs from The Tourism Network. Susan has over thirty years of successful tourism marketing experience. It’s for visitor-facing tourism businesses such as accommodation providers; visitor attractions; activity and experience providers; creative, retail, food and drink businesses.

Events

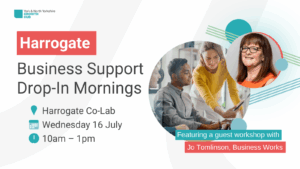

16th July 202510:00 am - 1:00 pmFREE

Harrogate Business Support Drop-In Morning

Free workshop included: Understanding Profitability. This Harrogate business support drop-in service can help answer your questions and direct you to relevant resources and programmes.

13th August 202510:00 am - 11:00 amFREE

How to get higher in Google: The basics

Want your website to be seen by as many potential customers as possible? Get practical tips from an experienced Search Engine Optimisation professional on how to woo those elusive search engine robots and climb the rankings.

11th September 202510:00 am - 12:00 amFREE

IP Readiness for Investment: A Strategic Guide for Early-Stage Businesses

Join Intellectual Property (IP) specialist Secerna for an insightful webinar designed to support early-stage businesses. You will learn why IP matters to investors, the most common pitfalls that derail funding rounds, and how to avoid them.

Resources

Vibrant and Sustainable High Street Fund Phase 2 - Webinar Series

This webinar series is designed to provide practical guidance and in-depth support with your application. Applications for Phase Two of the Vibrant and Sustainable High Streets Fund are now open, and will close at 5pm on the 31st July.

Featured Webinar Playlist: Wellbeing

Learn how to build resilience and communication, create a positive work environment, and support the mental health of both your team and yourself with our free wellbeing webinars playlist.

Webinar Recording: Why does Intellectual Property matter to your business?

This webinar will equip you with the knowledge to leverage IP for competitive advantage, investor attraction, and long-term business growth, ultimately showing you how a strategic approach to IP can be the difference between success and missed opportunities.