Business funding in a crisis

–

Whether due to economic downturns, unexpected challenges, or a range of other factors, businesses in the UK at risk of crisis or bankruptcy may find themselves in dire need of financial assistance. Fortunately, there are various funding options available to support struggling businesses during tough times. In this article, we will explore some of the key sources of funding that can help businesses weather the storm and get back on the path to sustainability.

–

–

Business support organisations

Business support organisations in the UK, such as local chambers of commerce, often provide financial support to struggling businesses. These organisations can offer advice, mentoring, and financial assistance through various grants and schemes. As well as the support we offer at the Growth Hub, you may also wish to look at the British Business Bank, the Federation of Small Businesses, or Funding Circle.

Commercial finance

Beyond government and grant-based options, businesses at risk of crisis or bankruptcy can explore commercial finance solutions. These include:

- Asset-based lending: Businesses can leverage their assets, such as stock, property or income due, as collateral to secure a line of credit or a loan.

- Invoice factoring: This option allow businesses to sell their outstanding invoices to a finance company, which provides immediate cash in exchange for a fee.

- Business loans and credit: Traditional bank loans or lines of credit may be available to businesses that meet their lender’s criteria. Private lenders and online lending platforms can also be considered.

Turnaround specialists

If your business is in severe financial distress or at risk of bankruptcy, it may be advisable to speak to a turnaround specialist or insolvency practitioner. They can provide guidance and financial support to navigate the challenging process of restructuring and recovery. These professionals can help negotiate with creditors, develop restructuring plans, and manage the company’s financial affairs during a crisis.

Facing a financial crisis or the possibility of bankruptcy can be a daunting and distressing experience for any business-owner and their team. But there are a number of potential options available to try and navigate these challenges, and, along with a proper financial plan that plots a path out of the crisis, they can help businesses at risk of crisis or bankruptcy regain stability and thrive once more. If you are in this situation, we encourage you to consult with financial experts as soon as possible.

Learn more

See what sorts of business funding are available

Find out more about managing costs in your business

–

–

Articles

Profitability

Profit is a measure of a business’s income relative to its expenses. In other words, an organisation’s ability to generate revenue by using resources that it has available, such as people, materials and equipment. Unless you are running a charitable organisation, profit is generally the primary goal of a company. As well as providing income for the owners of a business, profits allow for investment and growth. Whilst revenue growth is generally a positive indicator, we need to understand profitability if a business is to be successful.

BOOST: A marketing support programme for York and North Yorkshire tourism and hospitality businesses

This practical, action-oriented programme of activity has been developed to help you market your business more effectively, saving time and money. It’s created and delivered by Susan Briggs from The Tourism Network. Susan has over thirty years of successful tourism marketing experience. It’s for visitor-facing tourism businesses such as accommodation providers; visitor attractions; activity and experience providers; creative, retail, food and drink businesses.

Made Smarter Backs Unity Racing on the Road to Singapore

Made Smarter Yorkshire is proud to continue its support for Unity Racing, a team of six exceptional college students competing in the renowned F1 in Schools competition. As the reigning UK national champions, Unity Racing will once again take on the world stage this September, heading to Singapore for the highly anticipated global finals.

Events

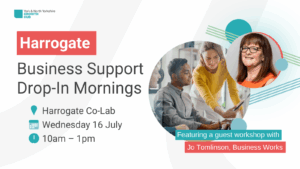

16th July 202510:00 am - 1:00 pmFREE

Harrogate Business Support Drop-In Morning

Free workshop included: Understanding Profitability. This Harrogate business support drop-in service can help answer your questions and direct you to relevant resources and programmes.

13th August 202510:00 am - 11:00 amFREE

How to get higher in Google: The basics

Want your website to be seen by as many potential customers as possible? Get practical tips from an experienced Search Engine Optimisation professional on how to woo those elusive search engine robots and climb the rankings.

11th September 202510:00 am - 12:00 amFREE

IP Readiness for Investment: A Strategic Guide for Early-Stage Businesses

Join Intellectual Property (IP) specialist Secerna for an insightful webinar designed to support early-stage businesses. You will learn why IP matters to investors, the most common pitfalls that derail funding rounds, and how to avoid them.

Resources

Vibrant and Sustainable High Street Fund Phase 2 - Webinar Series

This webinar series is designed to provide practical guidance and in-depth support with your application. Applications for Phase Two of the Vibrant and Sustainable High Streets Fund are now open, and will close at 5pm on the 31st July.

Featured Webinar Playlist: Wellbeing

Learn how to build resilience and communication, create a positive work environment, and support the mental health of both your team and yourself with our free wellbeing webinars playlist.

Webinar Recording: Why does Intellectual Property matter to your business?

This webinar will equip you with the knowledge to leverage IP for competitive advantage, investor attraction, and long-term business growth, ultimately showing you how a strategic approach to IP can be the difference between success and missed opportunities.