Business Basics – Directors Loans and Dividends

If you are the owner of limited company, there is every chance you will have a Director’s loan account.

Often business owners will inject cash into a business where they are a Director. This could be when the business is starting out, or to help with cash flow along the way. But how are these cash injections accounted for, and when can they be withdrawn?

The flip side of this is when Directors withdraw cash from the business, but, that withdrawal isn’t extracted as dividend, payroll or to repay expenses incurred personally. If a Directors loan account is overdrawn, what does that mean to you as a Director and what are the tax implications.

The Directors Loan Account

All limited companies should have an account set up in their accounting system to identify the moneys borrowed from or loaned to the company.

This account then tracks the money owed between a director and the company.

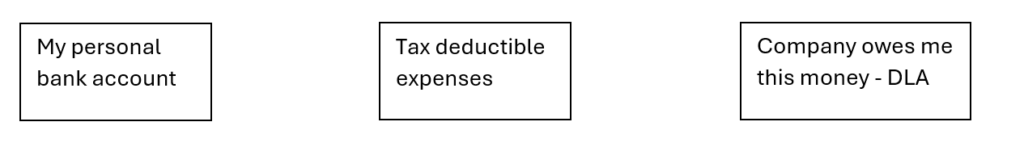

This account often has dozens of transactions going through it each year, and often the business owner is unaware of it. That is because, many of these transactions are not deliberate. Rather than a director loaning the business some of their money, meaning that the company will owe them this amount, and repay them at some point in the future when cash flow allows. Business owners often use their own cash or a personal account to pay for items, especially in the very early days when the bank account many not yet be established, or even prior to the business being set up. All of these transaction will be processed via the directors loan account.

If a director extracts funds from the business account for personal use, and these funds are not accounted for as:

- Repayment of expenses (receipts or mileage logs provided)

- Payroll

- Dividends declared

Then these extractions will also be processed via the directors loan account.

Transactions that go in and out of a Directors Loan Account (DLA)

Loan put into the Company

When a business is incorporated, and a business bank account is set up, there are often expenses to pay before any invoices are raised. Directors often put some of their own money into the business, as working capital.

This money is a loan, introduced by the director and goes into the Directors Loan account as such.

This money can be repaid at any time to the Director without incurring any tax liability, as it was a loan introduced being returned.

The company owes the director.

Receipts processed that were not paid via the business bank accounts or credit cards

Sometimes, when we are out and about, we may need to pay cash for parking, or we may accidentally use the wrong card, or have forgotten the business card.

If the spend was on a bona fida business expense, you can process the receipt through the business, and just account for the way it was paid for as being by the director. This may be processed directly into the directors loan account, or you may choose to set up a Bank of Jo (or whatever the name of the director is). Setting up a kind of bank account for the director is a useful way of identifying expenses that need to be refunded to the director during the year. Periodically you would check the balance on this account, and as long as funds allow, re-imburse the director for this balance.

If you utilise the sudo bank account, and the balance isn’t nil at the year end, this will be transferred to the directors loan account in readiness for year end reporting.

The company owes the director.

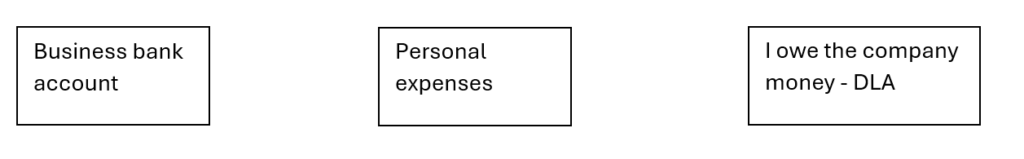

Receipts processed that were paid via the business bank accounts or credit cards, but are not tax deductible expenses. They are for personal expenses.

In the same way as above when the business owner inadvertently paid using a personal card for a business expense, the business owner may use the business card for a personal expense.

As these are not tax deductible expenses, these are coded to the directors loan account.

The director owes the company.

Directors Payroll

When money is tight, it is often the directors that go without pay. If the directors are on the payroll, you would typically run this as normal, and create a liability to pay the net pay to the director. But if there is no cash to pay them, or a decision is made to hold off paying this money over, for whatever reason, this can be transferred into the Directors Loan account.

This is accounted for as if it was a loan being made to the company, until it is paid to the director.

The company owes the director.

The director takes a loan

Directors will sometimes withdraw monies from the business bank account that is not covered by payroll, or expenses, and may be in lieu of dividends.

Directors often want to withdraw cash from the business monthly, to pay their living expenses, but this may be:

- more frequently than dividends are issued

- more value than can be issued as dividends once the profit after tax has been calculated

If withdrawals are made from the business bank account that are not net pay or reimbursement of expenses, they would be accounted for in the directors loan account, to be reduced by the amount of dividend if and when these are issued. Or repaid.

The director owes the company.

The director doesn’t take the dividend issued

If the company issues a dividend and the director does not take that dividend in full, as per the amount issued and the dividend voucher, the balance will go into the directors loan account as owed to that director, until it is paid in full.

The company owes the director

Dividends

A dividend is a payment made by a company to its shareholders out of post-tax profits (i.e. profits remaining after corporation tax is paid). It’s essentially the shareholders’ reward for investing in the company.

Dividends must:

Be from profit – Dividends can only be paid from accumulated profits (after tax). If there’s no profit, dividends can’t legally be paid.

Be declared – Directors must declare dividends formally, often through a board resolution.

Be per share – Unless there are different share classes (e.g. A & B shares), dividends must be paid equally per share.Have a dividend voucher – The company must issue a dividend voucher showing details of the dividend paid

Tax implications of Dividends and Directors Loans

Dividends

In the tax year 2025/2026 there is a dividend allowance of £500. This means that the first £500 of dividend income you earn, is tax free.

After this, dividends are taxed as below:

| Band | Taxable income | Dividend Tax Rate |

| Basic Rate | Up to £50,270 | 8.75% |

| Higher Rate | £50,271-£125,140 | 33.75% |

| Additional Rate | Over £125,140 | 39.35% |

Directors Loans

If, at the end of your financial year, the director is owed money by the company. Then there are no tax implications.

If at the end of the tax year, the director owes the company money – known as an overdrawn directors loan account, then, if the loan is not repaid within 9 months after the end of the company’s accounting period, the company must pay S455 tax.

S455 tax is:

- Due 9 months and 1 day after the end of the accounting period

- Due at a rate of 33.75%

- Refundable if/when the loan is repaid or written off

Benefit in Kind (BIK) – if an overdrawn directors loan is over £10,000 and no interest or low interest is charged, then:

- The director must – pay income tax on the deemed interest (HMRC expects a commercial rate)

- The company must report the benefit on a P11D and pay class 1A NICs on the BIK

Note – If a directors loan is written off, HMRC treats it as income for the director and it is taxed as either a dividend, or employment income

Bed and Breakfasting Rules

There can be a temptation for a director to repay the loan just before the 9 months deadline and then borrow it again.

HMRC may disregard repayments if:

- A loan is repaid, and a similar amount is re-borrowed within 30 days

- The repayment is funded by a dividend or salary and that was planned

These rules prevent manipulation to avoid S455 tax.

Tax planning using dividends and directors’ loans

The goal is usually to extract profits from the company tax-efficiently while avoiding unexpected liabilities like S455 tax, NICs, or illegal dividends.

Using a mix of salary, dividends and loans can create the most tax-efficient strategy.

Example (2025/26 tax year) – keep earnings within basic rate:

| Pay salary to NIC threshold | £12,570 | Qualifies for state pensionDeductible for CTNo income tax or NIC on the individual |

| Top up with Dividends | £37,700 | First £500 tax freeRemainder taxed at 8.75% |

| Directors Loans | If you need more funds that this out of the business, you can leave the balance as an overdrawn directors loanP11D if over £10,000S455 tax payable by the company at 33.75% |

Note – Speak to a professional to understand the tax implications relating to your specific circumstances.

If you have introduced funds into a company, you can charge interest on these funds, at a market rate.

Articles

HMRC asks Self Assessment customers in Yorkshire and the Humber ‘What’s your filing style?’

With less than two months until the Self Assessment deadline, HM Revenue and Customs (HMRC) is asking people filing their tax return for the 2024 to 2025 tax year ‘What’s your filing style?’ and encouraging them to start now.

Autumn Budget 2025 – How will it impact your business?

The language used by Chancellors during the delivery of such a Budget can often be headline grabbing, assuming you can hear them over the general noise in the House of Commons. But what filters out over the following days and weeks can regularly feel somewhat different to the words you heard during the budget speech.

Create your winning Marketing Plan for 2026: Workshop

Free one-day training for Tourism businesses across York & North Yorkshire - with sessions across Skipton, Scarborough, Northallerton, York and Harrogate. It’s a tough market and costs are rising all the time for hospitality and tourism businesses. This means that you need to increase revenue, and smarter marketing is one definite way forward.

Events

11th December 202512:00 am - 1:00 pmFREE

[FULL] Social Media Ads & Paid Campaigns: Tadcaster

Join us for 📢 Social Media Ads & Paid Campaigns in Tadcaster on Thursday 11 December. Ready to scale up? If you’re already active online and want to reach more customers, this is for you.

31st December 20259:30 am - 12:15 pmFREE

[FULL] Export Roadshow: Harrogate

This roadshow is a great opportunity to network with other businesses looking to grow and ask questions of the experts. It will provide you with helpful advice, routes for support beyond the event, including the UK Export Academy, and information about other funding opportunities.

13th January 202610:00 am - 1:00 pmFREE

Online Workshops: Digital Marketing Success Series (Beginner)

Each workshop is packed with real-world examples, guided how-to sessions, and space to ask questions and get feedback so you can apply what you are learning to your own business and individual needs. All delivered online so you can attend without having to travel, perfect for rural and coastal businesses across North Yorkshire.

Resources

Webinar Series: How to Run a Pop-Up

From pop-up department stores to kitchen takeovers, cool things are popping up and popping off everywhere. In this exciting project, you’ll get to meet some of the teams behind these pop-ups and get their top tips for running a great pop-up.

Webinar Recording: 🟢 Data Protection Essentials

In this engaging and practical webinar series, Privacy Protect Group Ltd will guide you through everything you need to know to build a confident, compliant, and resilient approach to data protection in your business. Whether you’re just starting out or looking to refine your practices, each session is designed to build your understanding step-by-step.

Webinar Series: Data Analytics for Smarter Decisions

Data Analytics for Smarter Decisions, is a nine part online workshop series designed to help businesses at every stage of their data journey, from those just starting out to those ready to explore artificial intelligence and compliance. Each session is practical, jargon free and grounded in real business use cases, ensuring participants leave with tools and knowledge they can apply immediately.