Business Essentials – Associated Companies

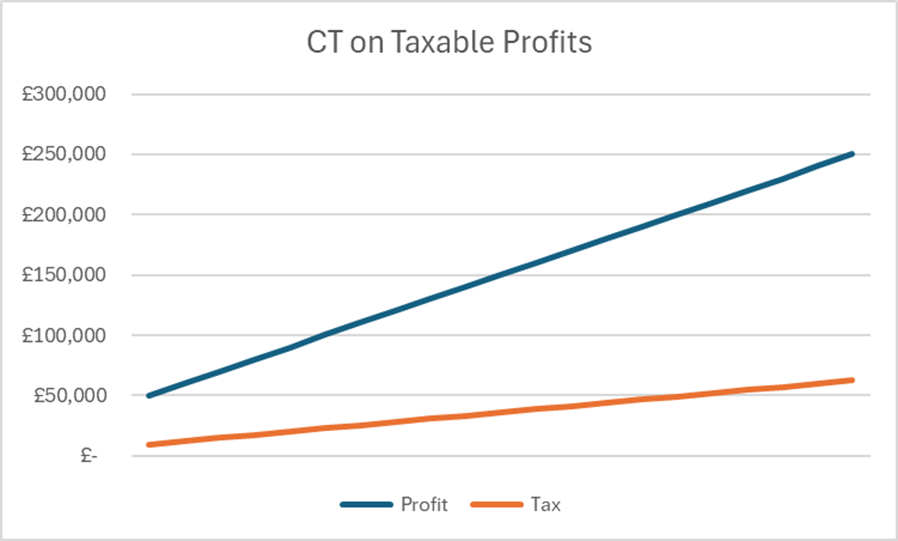

From April 2023 the Corporation Tax rules changed, with the headline being an increase in the main rate of Corporation Tax to 25%. From this date, companies whose taxable profit was less then £50,000 would be subject to the small profit rate of 19% Corporation Tax. Companies with profits between £50,000 and £250,000 will pay a gradually increasing effective rate of taxation due to something known as marginal rate relief.

As this could lead to company owners wanting to split their trade over multiple companies to avoid paying more than 19% tax, several rules were brought in at the same time to avoid this.

Corporation Tax

This is the tax paid by limited companies on the profits they make. The main tax rate is 25%, but businesses who have taxable profits of less than £250k will pay less than 25%, and can pay as little as 19%

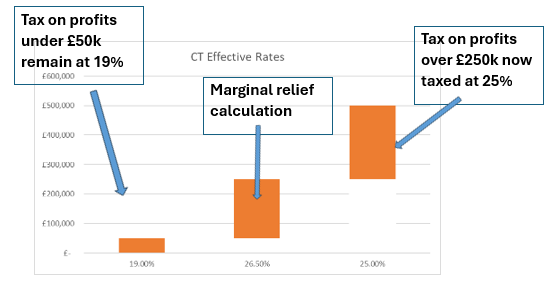

Businesses with taxable profits of less than £50k are taxed at 19%, and then for profits over £50k something known as marginal rate relief is used to determine the amount of tax paid. Using this calculation method, the overall tax rate creeps up from 19% to 25% as profits rise.

Marginal Rate Relief Calculation

If taxable profits are greater than £50k, then the tax rate goes to 25% less the marginal rate relief amount. The formulae if complicated to look at, but what it does can be shown in a much simpler way too.

So, if the taxable profit is £100k, you would take this £100k away from £250k (the amount over which a straight 25% tax is charged), so this would be £150k. You then multiply this number by 3 and divide by 200. In this example we have £150k x 3/200 = £2,250. You then deduct this amount from the tax calculation at 25%. So, we have £100k x 25% tax = £25,000 less the marginal amount of £2,250.

| Tax charged at 25% | £25,000 |

| Less marginal relief | £2,250 |

| Tax chargeable | £22,750 |

Another way to look at this complicated sum, if to use effective rates. If the first £50k is always taxed at 19%, then the next £200k is taxed at an effective rate of 26.5%. In our example this would be:

| £50k Taxed at 19% | £9,500 |

| £50k Taxed at 26.5% | £13,250 |

| Tax chargeable | £22,750 |

Either way, the overall amount of tax paid is the same and this equates to 22.8% when taxable profits are £100k.

Unlike income tax, the relevant CT rate applies to all of the company’s profits. So, once a company’s profits exceed the upper limit, the entirety of their taxable profit will be taxed at 25%, and not just the amount by which they exceed the upper limit.

Associated Companies

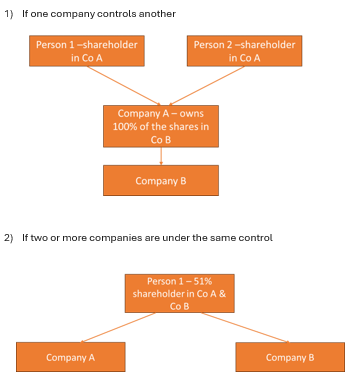

The HMRC definition of associated companies is below:

A company is an ‘associated company’ of another company if one of the two has control of the other, or both are under the control of the same person or persons.

A person is treated as having ‘control’ of a company if they exercise, are able to exercise, or are entitled to acquire, direct or indirect control over company affairs. It includes the possession of, or right to acquire:

- the greater part of the share capital or issued share capital of the company

- the greater part of voting power

- so much of the issued capital in the company, that they would have the right to receive the greater part of the company’s income, should it all be distributed

- rights to the greater part of the company’s assets on winding up

If two or more persons together satisfy any of the above conditions, they are treated as having control of the company.

So, for companies to be deemed as associated, you don’t necessarily need to have control, but you COULD have control!

| Associated Companies | 1 | 2 | 3 | 4 |

| Lower rate | £50,000 | £25,000 | £16,667 | £12,500 |

| Upper rate | £250,000 | £125,000 | £83,333 | £62,500 |

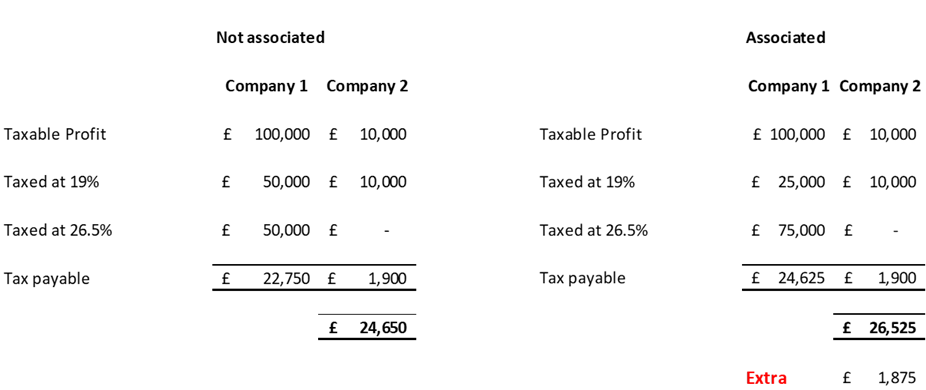

Is it important for us to establish whether companies are associated, because if they are, all the upper and lower limits for taxable profits in the calculations above, are shared between those companies. The more associated companies, the lower the limits for taxable profit, and the higher the tax paid (up to the main tax rate of 25%).

Family members shares could also be considered

If there is substantial commercial interdependence

- Financial – Intercompany loans

- Economically – Trade of one relies on the trade of another/common customers (commissions/referrals or something else)

- Organisationally – Common management, employees, premises, equipment

If yes – then we need to consider family members

If there is substantial commercial interdependence, then family members shareholdings can be combined with yours to determine control!

Family members to be looked at:

- Spouses or civil partners

- Children or grandchildren etc

- Parents or grandparents etc

- Brothers or sisters

- Trustees of any settlements

Total strangers could also be considered!

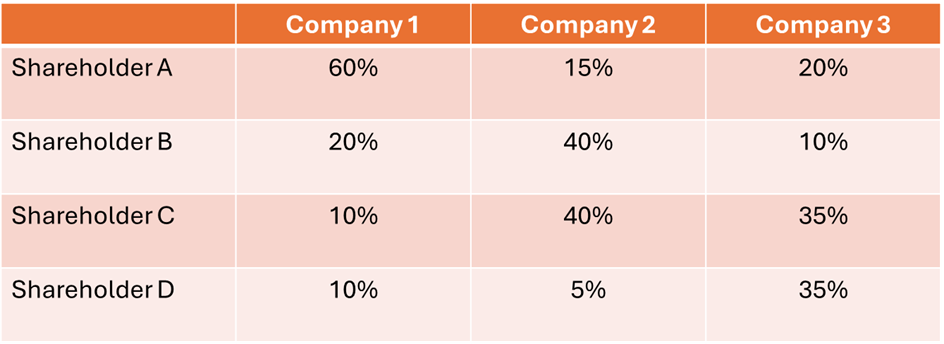

Where there is no single shareholder who is in control of a company, we need to consider Minimum Irreducible Groups or minimum controlling combinations.

- This is where a group of individuals who together would have control of more than one company would have their shareholdings added together to make a controlling interest

- This is looking at the fact that they COULD form a controlling relationship

Control could be at any time during the tax year, it doesn’t have to be for the whole year. So, if a company is new, purchased or sold during the year, or in fact liquidated or struck off, they may still be included.

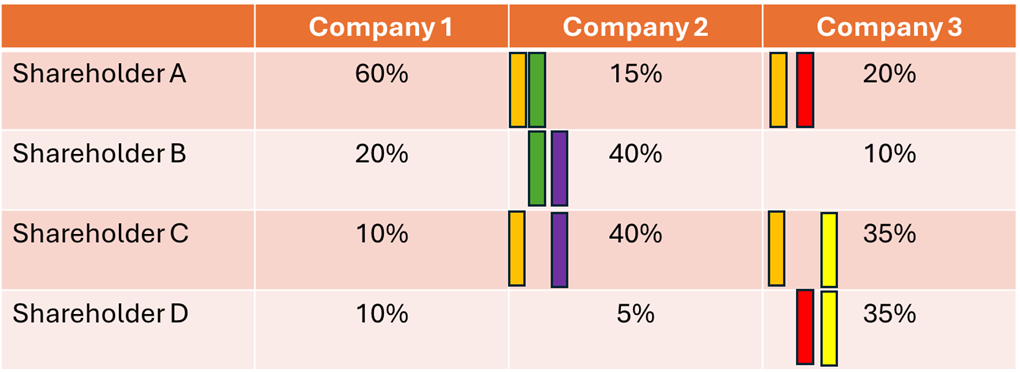

Lets look at the following example of 3 companies with multiple shareholders.

Control could be at any time during the tax year, it doesn’t have to be for the whole year. So, if a company is new, purchased or sold during the year, or in fact liquidated or struck off, they may still be included.

Lets look at the following example of 3 companies with multiple shareholders.

As Company 1 has a clear owner, with 60% of the shares, then we don’t need to look at this Company under Minimum Irreducible Groups.

But for Companies 2 & 3, are there any ways in which by adding the shares of two of the shareholders, you would have a potential for control. Each incidence of this has had colour coded bars put to the left of the shareholding.

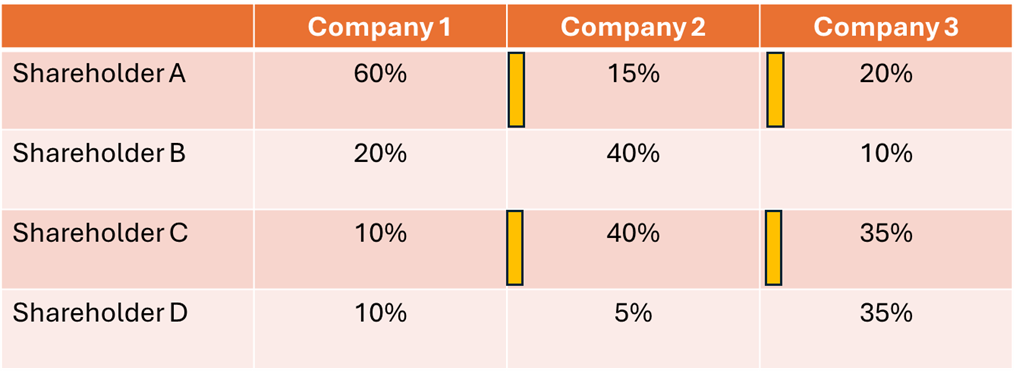

If we just show the ones where two shareholders have the potential to control these two companies, then we can see that these will fall into the Minimum Irreducible Groups and be deemed to be associated companies, even if the shareholders do not know each other.

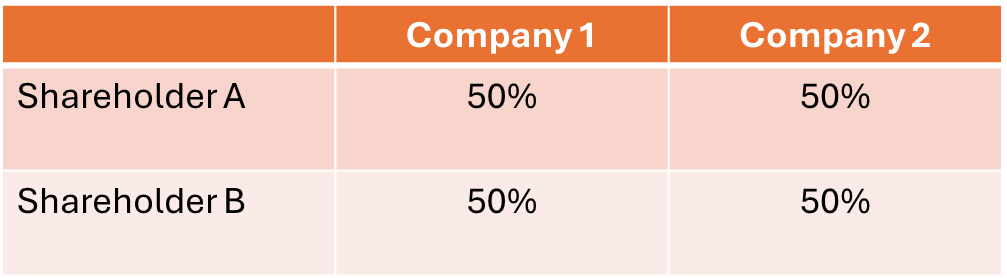

Another example is where two people each have 50% of the shares in two or more businesses in common.

Tax implications

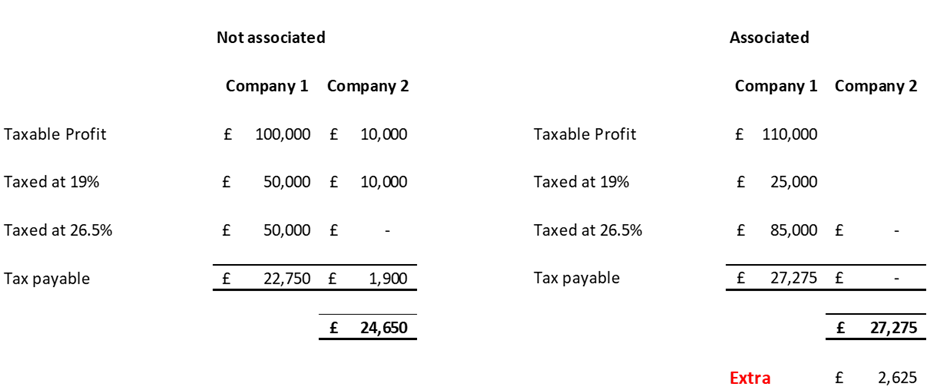

Let’s look 2 examples where we have 2 companies that are associated, and two that are not, and how this impacts the tax due.

Which Companies can be ignored?

In some circumstances a company will be ignored for the purposes of Associated Companies, for example:

- Non-Trading Companies

- Dormant Companies

- A passive Group Holding Companies (even if they have income in the form of dividends but are otherwise non trading). But they must:

- distribute the whole of that dividend income to their shareholders to be ignored for these purposes.

- Have no assets other than a minimum of 51% shares in subsidiaries

- Have no chargeable gains

- Have no management expenses or charitable donations

Companies excluded from the small profits rate

Some companies will always be subject to the main rate of CT, regardless of their profit levels.

- Non-UK resident companies

- Close investment companies

Sole trader businesses are not affected by associated company rules, so if you are considering a second company, you should consider trading via a sole trader business as the second commercial entity. Whilst in some cases, this might be the best course of action, often if there are good commercial reasons to have two companies, then this will be the case regardless of associated company rules.

Steps into Digital Programme

The Steps into Digital programme focusses on strategic, guided steps toward adopting the right digital tools and practices for your business. Emphasising a supportive, paced approach to digital transformation, accessible and manageable to all at any level.

Business Essentials – Associated Companies

From April 2023 the Corporation Tax rules changed, with the headline being an increase in the main rate of Corporation Tax to 25%. From this date, companies whose taxable profit was less then £50,000 would be subject to the small profit rate of 19% Corporation Tax. Companies with profits between £50,000 and £250,000 will pay a gradually increasing effective rate of taxation due to something known as marginal rate relief.

Four issues key to social enterprise survival

Social enterprises face a unique and complex series of issues. To ensure the long-term health and survival of your social enterprise, an understanding of these issues is vital. In this article, I will summarise four key areas you need to consider: sources of funding, governance considerations, the power of people, and sustainable growth.

Horizon Scanning: Four questions social enterprises need to answer

With so much going on in the present, it’s not always easy to look to the future. However, the identification of potential risks and opportunities is vital to the long-term health of any business, and social enterprises are no different. Horizon scanning helps in assessing whether you are adequately prepared for future changes or threats.

The Benefits of Local Business Networking

Building relationships with other businesses through local business networking can be incredibly rewarding on a personal level as well as a shrewd business decision. Forging friendships with other people, many

Why Business Continuity is Important

Preparing for the challenges a business might come up against when times get tough can seem like a mammoth task. You want to protect your business and guarantee that it