Business Basics – Cash Flow v Profit

Many small business owners can get confused when looking at numbers relating to their business, and often this is due to cash and profit being understood as one and the same thing. It is crucial to understand the difference between these two metrics so that decision making is not flawed.

Most businesses will report profit on something called the accrual basis. A concept whereby revenues are only counted once they are earned, rather than when the cash is received. This is where most of the confusion originates.

The Accruals Principle

The accruals principle requires that income and expenses are recorded in the period they relate to, not when the cash is received or paid.

UK accounting standards such as FRS 102 and FRS 105 require the use of accrual based accounting.

In the UK, most limited companies and LLPs are legally required to use the accruals basis when preparing statutory accounts for HMRC and Companies House (unless they’re very small and eligible to use simpler cash accounting under FRS 105).

Income is recognized when it is earned, rather than when the payment is received.

For many businesses, especially those who sell services, invoices are typically raised:

- Once a piece of work is completed

- At the end of the week or month, for work done in the previous period

- Staged payments towards the completion of a project

- As a deposit followed by the balance on completion

- For building works, a retention can be kept back for an extended period of time (often a year)

But under the accruals system, we need to consider when income was earned, as this is the revenue that will be reflected in your accounts.

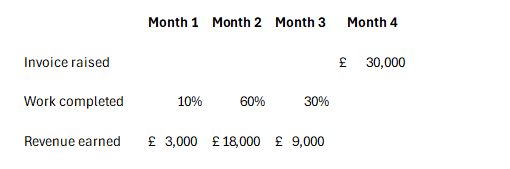

If we take the example of a project, being delivered over a period of around 3 months.

The costs associated with this project we will look at in detail in a moment, but they will be consumed throughout the 3 months, whilst the project is being delivered.

The accruals system says that we should match the costs incurred with incomes earned, and this also works from a management accounting perspective, as when we look at our accounts on a monthly, quarterly or annual basis, we want to see what profit we made from the activity we did in that period.

1) Invoice raised on completion of the project

We should accrue income in months 1, 2 and 3, which will then be invoiced in month 3.

These incomes will then match with the wages we will incur each month and any other costs associated with the project.

2) If we invoiced at the end of the week or month for the value of work done to that point, our invoicing is likely to be largely in line with the revenue earned

3) Sometimes we agree a staged payment plan associated with a project, and we may invoice in line with these stages. The idea of this system is to match up with when the work is done. We may still need to accrue incomes, if there is a large stage, and this covers a number of weeks/month.

This is used extensively in the building trade.

4) Deposits, followed by a balance on completion.

Deposits could be taken many weeks or months before the delivery or the service. For example a venue may take a deposit, or a photographer, or trainer, this system is also used extensively in the holiday sector.

Deposits are deemed to have been earned at the point when they are no longer refundable. Up until this point, we should not recognize them as income.

It is a good idea to account for deposits in a separate balance sheet account, against the specific customer, so that you can keep track.

5) As retentions are about cash being withheld, rather than the work being completed. The whole value of the project is accounted for as it is earned. The retention portion of the invoice is then accounted for as remaining outstanding until it is paid (often 6-12 months later).

Expenses are recorded when they are consumed, not when you pay for them.

Many of the costs incurred by a business will be largely in line with the timing of the bill being received. Unless the company invoicing you is doing so using one of the principles above which calls for an accrual of income. As the recipient of services, invoiced in a different time frame to the delivery/consumption of the cost. You may need to accrue for some costs to ensure you are matching costs consumed and revenues earned within an accounting period.

1) Accruals – Where you have received goods or services, and have not yet received an invoice covering this costs, you should accrue the cost in your accounts.

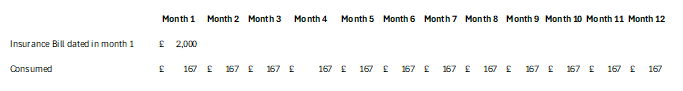

2) Prepayments – When you receive a bill for a service that will last over a period of time, but you consume it over that period of time, you should spread the cost in your accounts to reflect the consumption of the service. For example:

- Insurance

- Council Tax

- Some software subscriptions

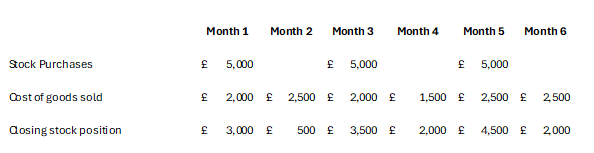

3) Stock – Buying and selling goods

When we buy and sell goods, we tend to buy those goods in bulk and sell in much smaller quantities. Invariably we will be left with items in stock at the end of the accounting period. So, if we are to use the same matching principle, only showing in the accounts, the costs consumed, we need to account for stock.

4) Stock – Work in Progress

If you put multiple stock items together, to create the goods you sell, then you will also need to value work in progress for your stock calculations.

This is often described as manufacturing, but could be pulling separate items together to form a hamper, for example.

The process of utilizing multiple stock items together to form a different item for sale, will often mean that you use other costs, like man hours, or utilities too.

When we value work in progress, the full cost of getting the goods to the position they are in as at the period end, should be included in the value

Accounting for Accruals and Prepayments – mostly done by accountants and bookkeepers, and is done using a journal voucher.

A Journal voucher is used to record adjusting entries, not captured by regular business processes, like sales, purchases and payroll.

Cash Flows

In most cases, a transaction will have two relevant dates for accounting purposes. The transaction date on the Bill/Expense or sales invoice, but also the due date.

More importantly, for cash flow, is the date something was actually paid. The date the monies went into or out of the business bank account, or is forecast to.

These two dates, and the timing difference between them, can cause confusion.

If we refer back to the examples we looked at above, then we can see how the cash flows can be very different from the accounting entries.

In this example, if we pay in full once the bill is received, but the service is consumed over the next 12 months, we have cash in advance of consumption.

But we may pay monthly, which would then be in line with consumption, or, if its for business rates, we may pay over 10 months… a third set of potential timings…

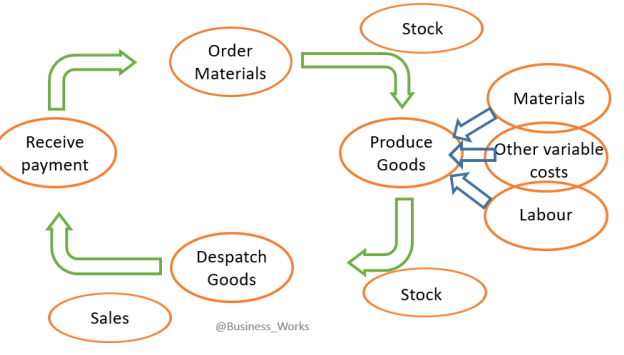

3) Stock

Sometimes we need to pay for stock when we order it. It then needs to be delivered, which can take time, especially if we are importing it.

Then it gets delivered into stock.

Then we may convert the items delivered into something else (manufacturing), incurring more costs, before we can even think about dispatching the stock and raising a sales invoice.

Then, we may have terms on our sales invoice, which means our client/customers doesn’t pay for another month or possibly more.

In this kind of business model, we need to really think about the accounting entries and cash flows.

Cash flow forecasting

When converting the profit and loss elements of a forecast into a cash flow forecast, you need to consider a few non profit and loss items, and timing.

- Non-profit and loss transactions

- Loans – Where you have a loan built in, you will need to include the repayment of the loan.

- Directors Loans – If you take a regular amount out of your business as a directors loan, that may be converted to a dividend at the end of the year.

- Payment of taxes

- VAT – for most people, VAT will be based on a quarterly cycle paid one calendar month and 7 days after the end of the VAT quarter

- PAYE and Pension contributions:

- Wages are paid to employees net of deductions at a timing dictated by your employment contracts

- Deductions made from staff salaries, plus employers’ national insurance and employers pension contributions are paid over after wages are paid. Mostly, this is on or before the 19th of the following month

- Corporation Tax – due 9 months and 1 day after the company year end

- Buy back of equity (unless the plan is to sell the whole business in the medium term rather than buy back the equity)

- Other timing considerations

- Payment terms – How long does it take each of your customers to pay? This may be longer than your standard terms.

- Better credit control procedures can improve this

- Stock purchases – If you use stock in your business, you will most likely buy in far greater quantities than you sell in, which leaded to holding stock.

- Stock ties up cash and can cost in storage too, but order quantity impacts the price of what you buy, so this is a delicate balance

- Often, to release goods, you have to pay, so you need to take account of:

- Whether the items are in stock at your supplier, or need to be schedules for manufacture

- Shipping time

- Customs, if importing

- Conversion, once you receive the items

- Payment terms – How long does it take each of your customers to pay? This may be longer than your standard terms.

Future Cashflow liabilities

It is really important that we understand our future cash flow liabilities so that:

- We don’t run out of cash – it can take weeks to organise funding

- We don’t spend cash that is in the bank now, but should be earmarked for these future liabilities

Forecasting Profit and Cash

It is good business management to forecast both profit and cashflow. The profit forecast will help you focus on profitability and help you to maintain and grow profitability. But the cash flow forecast will ensure you understand if you are at risk of running out of cash, and when you should look to source outside finance.

Autumn Budget 2025 – How will it impact your business?

The Autumn Budget, announced on 26 November 2025, introduced a range of changes that business owners need to be aware of. From updates to taxation and compliance rules, to adjustments in incentives and support schemes.

Risk and Resilience in Your Business

Running a business can be risky. There are so many things that can impact your performance, and profit. Potentially destroying all that you worked so hard to build. Some of these things are impossible to plan for, but lots of potential risks can be mitigated by identification and planning.

Business Basics – Cash Flow v Profit

Many small business owners can get confused when looking at numbers relating to their business, and often this is due to cash and profit being understood as one and the same thing. It is crucial to understand the difference between these two metrics so that decision making is not flawed.

Business Basics – Project Evaluation

Projects can be anything from taking on a new person, or launching a new product, to building a manufacturing site, or acquiring a business to merge with the current one. How you evaluate each project can vary depending on size and complexity. But undertaking the exercise leads to better decision making and control.

Building Resilience and Sustainability into your Farming Business

Resilience and sustainability lie at the heart of modern farm business strategies, ensuring that agricultural enterprises can withstand economic shocks, adapt to evolving environmental regulations, and maintain profitability amid climate volatility. By embedding sustainable practices, ranging from energy efficiency to regenerative soil management, farmers not only safeguard their livelihoods but also contribute to broader goals of food security and environmental stewardship.

Business Basics – Shared Ownership

Directors and shareholders of UK companies have many rights and responsibilities, but how do these change when you are one of a number of shareholders in a company?

Business Basics – Selling a Business or Shares in a Business

Being aware of your business's value enables you to determine a fair selling price for some or all of your shares and negotiate efficiently with prospective buyers. But where do you find a buyer for your shares, and what happens now?

Business Basics – How much is your Business Worth

Being aware of your business's value enables you to determine a fair selling price for some or all of your shares, negotiate efficiently with prospective buyers, and secure beneficial financing deals, among other advantages.

Business Basics - Forecasting

Although we don’t have a crystal ball, so forecasts are fundamentally informed guesses, businesses need to use them to make informed business decisions and develop business strategies.

Business Basics – Accessing Capital for Growth

Gaining access to outside investment means you don’t have to give up on your dream. So how do you prove to any potential investor that your business model is worth

Farm Diversification: Where to start

According to DEFRA, 71% of farm businesses in 2023/24 have some form of diversified activity, up from 61% in 2014/15. Income from these activities produced £1.393 billion in 23/24, up from £1.321 in the previous year. This demonstrates how important these income streams have become.

Business Basics – Making Tax Digital

Making Tax Digital (MTD) for Income Tax and Rental Income is the biggest change to Self-Assessment since it was launched by HMRC over 30 years ago.

Young Entrepreneur Guide

Do you have a business idea? Or do you want to work for yourself? Then the Young Entrepreneur Guide is here to help you!