Business Essentials: Company Structure

There is a lot of information around about company formats and the associated rules and tax regimes and a lot has changed in recent years. So, what is the best structure to run your business through? Your choice of business vehicle affects the type of taxes you pay, your liability for business debts and the legal and administrative requirements imposed on the business. In deciding on the right structure for the business, it is necessary to take account of all the relevant factors and also your attitude to risk.

The main business structures in the UK

Limited Company – LTD

The first point to note about a limited company, is that it is a separate legal entity from any owners or managers of it. In the UK it is easy to incorporate (the term used for starting a limited company) a new limited company. It is not you and you are not it. This leads to one of its main benefits, and a few rules.

- Limited Liability

- A shareholders’ liability is limited to the amount they invest in the company

- Separate legal identity

- The company can enter into contracts in its own name

- The company’s finances are separate from the owners’ personal finances, so the shareholders personal assets are protected if the company goes bankrupt

- The company can be sued in its own name

- The company can continue to operate even if the shareholders retire or resign

- Tax – we will go into more details around tax later in this document

- Pays Corporation Tax

- Has to submit a corporation tax returns and accounts using a form CT600 to HMRC annually

- Has to submit accounts to Companies House annually

- Access to funds

- It can be easier to get investment

- It can be easier to get loans

- Costs

- It can be a little more expensive when you run your business through a limited company for things like:

- Accounting fees (depending on which legal format you compare it to)

- Insurances

- Interest on mortgages

- It can be a little more expensive when you run your business through a limited company for things like:

Sole Trader

If you are running your own business as an individual or work for yourself, you are trading as a sole trader. This is the simplest set-up and the proprietor gets to keep all of the profits after tax, but he or she is also liable for all of the business debts. With this business format, there is no legal separation between you and the business in the eyes of the law.

- Liability

- is not limited to the business, as you and the business are the same legal entity

- Legal identity

- the name you give to your business is known as a ‘trading as’, so if you had a sole trader business, you might be Joe Bloggs trading as Widgets World, as an example.

- Tax – we will go into more details around tax later in this document

- Pays income tax and Class 4 National Insurance

- Submits a self-assessment tax return to HMRC

- Access to funds

- Will depend on your personal credit rating

- May request an SA302 – a summary of earnings from all sources

- Costs

- Can be a little lower than other business formats for

- Accountancy fees (more people do their own self-assessment tax return than any other form of tax return)

- Insurances

- Interest on mortgages

- Can be a little lower than other business formats for

Charities

Organisations that give money, food or other help to people in need. Established for the public benefit, they cannot make a profit.

There are several types of Charity structures. Charitable incorporated organisation, Charitable company (limited by guarantee), unincorporated association or Trust. The rules for each type vary, so lots of research is required before you start.

Charities are set up to support and protect the most vulnerable aspects of our society, so its to be expected that there are a lot of additional rules that they must adhere to.

- There are no shareholders

- It is run by the trustees for the benefit of its purpose as declared

- In most cases, a registered charity is not subject to tax, but is still required to produce and submit accounts

- Must report to the Charities Commission Annually

- Accounts may need to be audited or independently examined

Community interest companies (CISs)

Organisations that operate to benefit the community they serve.

- Has a lot of the characteristics of a limited company

- There are no shareholders/owners

Popularised due to them having a greater ability to access grant funding

Limited Liability Partnerships (LLPs)

A business structure that combines the flexibility of a partnership with the limited liability of a corporation

- Partners pay income tax

- Partners share of profits can vary year on year to reflect the value they bring to the partnership

Company Limited by Guarantee

A company without share capital, where members are liable for a set amount if the company is dissolved, namely the guarantee amount.

- Similar to a limited company

- Popular with charities, clubs and membership organisations

- Has no shareholders, but must have Directors

Shared ownership of a Company

There are many circumstances where a business will be owned by multiple people. Before you enter into a situation where you are in business with other people, you should consider:

1) Who is/are your business partners

a. What do they bring to the business?

i. Funds

ii. Skills

iii. Contacts

2) How will the profits of the business be split?

a. Always in the same proportion

i. This would lend itself to a LTD Company

ii. Each shareholder would receive Dividends in the same proportion as their share ownership

b. Proportions may vary

i. It is possible to split the profits differently over a period of time with

1. A sole trader partnership

2. An LLP

In all cases, if you are looking to start a business with someone else, then you should enter into a shareholder or partnership agreement first. This establishes ground rules for the partnership and the partners and can reduce misunderstandings later, once the business has a value.

Tax Treatment

Corporation Tax

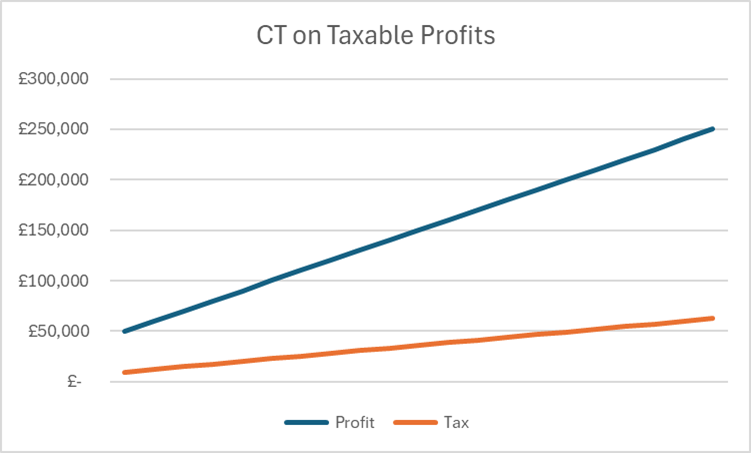

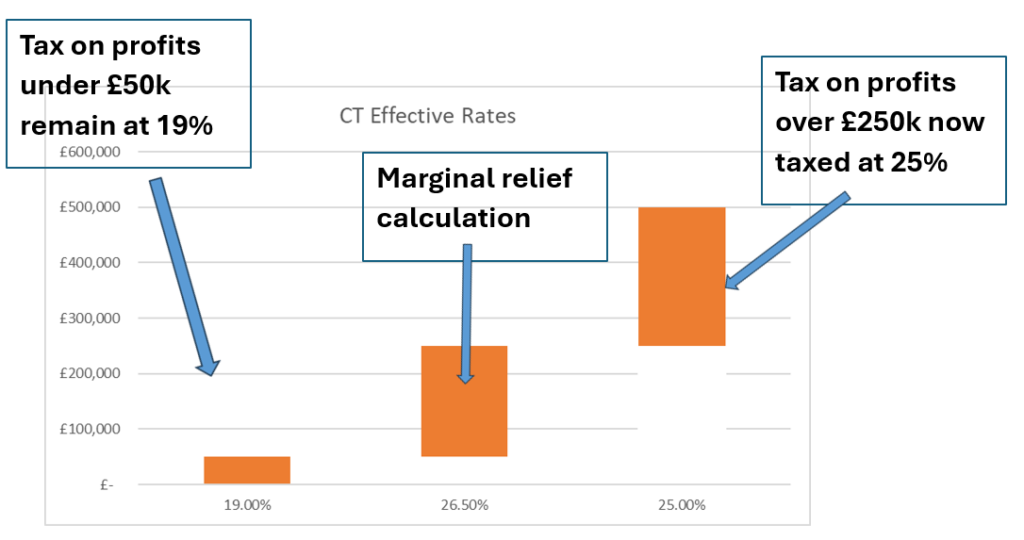

This is the tax paid by limited companies on the profits they make. The main tax rate is 25%, but businesses who have taxable profits of less than £250k will pay less than 25%, and can pay as little as 19%

Small Businesses with taxable profits of less than £50k are taxed at 19%, and then for profits over £50k something known as marginal rate relief is used to determine the amount of tax paid. Using this calculation method, the overall tax rate creeps up from 19% to 25% as profits rise.

Because, in all cases, the first £50k is taxed at 19%, this means that profits earned in between £50k and £250k are actually taxed at an effective rate of 26.5%. You should consider this when looking at any taxable spend and its impact on the businesses overall tax liability

Income Tax

This is the tax paid by individuals and members of LLP’s. The rates and allowances are the same as for people in employment. From April 2025 the rates and allowances are:

Personal Allowance £12,570 Not taxed in most circumstances

Basic Rate £37,700 20%

Higher Rate £87,440 40%

Additional Rate Above £125,140 45%

If you earn over £100k, you will start to lose your personal allowance at a rate of £1 for every £2 you earn over £100k. So, you will pay an effective rate of 50% tax on earnings between £100k and £125,140.

National Insurance

This is also a tax on individuals, along with income tax. But whilst it is taxed on the same people, it has different rules, rates and allowances.

National Insurance is paid by both the income earner and, in the case of employment, the employer.

- Employees National Insurance

Allowance £12,570 Not charged up to the Primary Threshold

Basic Rate £37,700 8% Between Primary Threshold and Upper Earnings limit

£50,270 2% on earnings over the Upper Earnings Limit

- Self Employed National Insurance

Allowance £12,570 Not charged up to the Primary Threshold

Basic Rate £37,700 6% Between Primary Threshold and Upper Earnings limit

£50,270 2% on earnings over the Upper Earnings Limit

- Employers National Insurance

Allowance £5,000 Not charged up to the Secondary Threshold

Rate 15% on all earnings above the Secondary Threshold

NOTE – Eligible employers can reduce their National Insurance liability by up to £10,500 p.a. in 25/26 by using the Employment Allowance. This is up from £5,000 p.a. in 24/25.

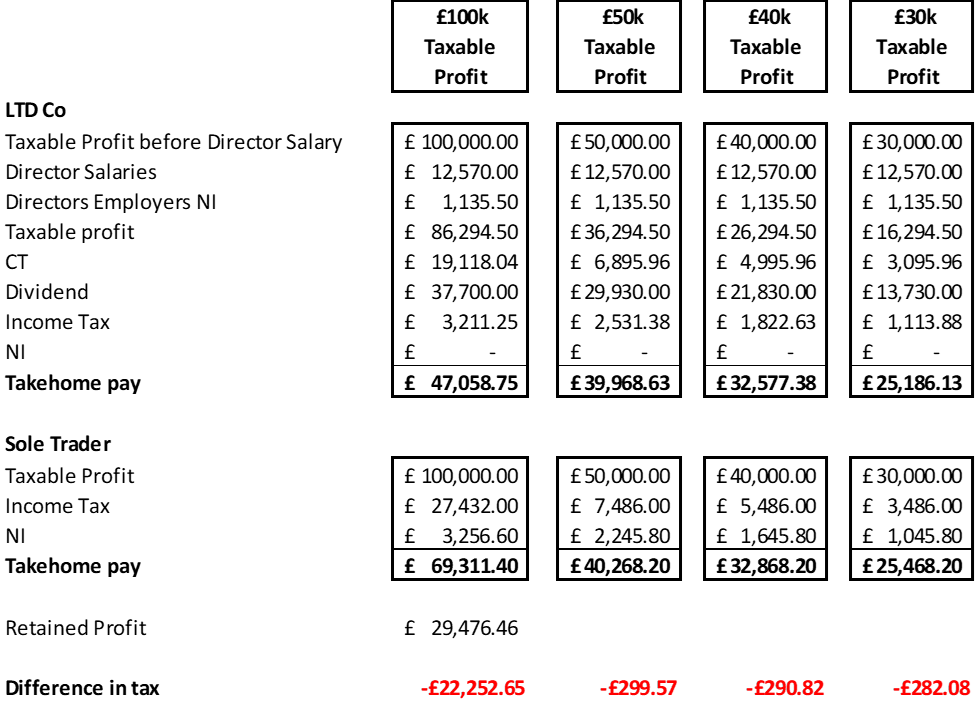

The changes in National Insurance in recent years have eroded the tax benefits that used to be seen when people chose to operate through a Limited Company rather than as a Sole Trader.

Now, the tax benefits of Limited Companies over Sole Traders are only around tax planning.

Sole Traders are taxed on whatever taxable income is earned in that tax year. Whereas, though companies are taxed on their earnings in that tax year, the shareholders who own them are only taxed on the earnings extracted in that tax year. So, it is possible, to restrict overall earnings, and avoid higher rate dividend tax.

In the examples below, we can see that with taxable profits of up to £50k you will pay less tax as a sole trader than if you operate via a limited company.

But if you have taxable profit and restrict your total earnings extracted from this business to £50,270 in that tax year, and leave the remaining £29,476 in the business, to be extracted in another tax year, (where the individuals taxable earnings may be smaller), this can save a significant amount of tax.

In the table below you can see that with taxable profit of £30k, £40k or £50k, there is a small amount more tax to pay via a LTD Company versus a sole trader business format.

If you take the example of a business with taxable profit of £100k however, the sole trader has no option but to pay tax on all of this profit in that year. Whereas the limited company owner could choose to restrict earnings to £50,270. In this example the sole trader format yields a higher takehome pay in that year. But the limited company owner, has left almost £30k in the business to potentially extract at the lower rate dividend tax of 8.75%. So, whilst in this example the sole trader format gives £22,252 more take home pay, the retained profit less lower rate dividend tax would be worth £26,896 to the business owner in a future year.

Dividends

In the tax year 24/25 you can earn up to £500 in dividends before you start paying tax. This is known as the dividend allowance.

Dividends are taxed based on the income tax bands

Lower rate 8.75%

Higher Rate 33.75%

Additional Rate 39.35%+

Capital Gains

Limited companies pay corporation tax on all income earned, including the sale of items with a capital gain

Individuals pay Capital Gains Tax, but they also have an annual exemption amount which currently sits at £3,000 per person in any tax year.

In the tax year starting in April 2025 the rates of tax for capital gains are 18% for basic rate earners and 24% for higher rate earners.

Starting and Stopping a Business

Limited Companies

Starting Up – Incorporation

- Come up with a unique name, not currently in use by any other company

- Incorporate the company (£50 payment to Companies House)

- HMRC issue a company Unique Tax Reference (UTR)

Ceasing

- Strike Off – When a company has no debts.

- Members Voluntary Liquidation – When the company has assets but wants to stop trading and a liquidator is appointed to distribute the remaining assets

- Liquidation – when a company cannot pay its creditors

Note – You can make a company dormant but must still do some limited reporting. This is often done to keep the company name.

Sole Traders

Starting Up

- Inform HMRC that you are trading as a sole trader

- HMRC issue a Unique Tax Reference (UTR)

Ceasing

- Include a cessation date on your self-assessment tax return

Associated Costs

As you have seen in this article, the business formats that require registration with Companies House are more complex, they have more rules and they also have more costs.

Accounting Fees

- With a Sole Trader business, you only have to produce a statement of income and expenses and fill in a self-assessment tax return once a year. Accounting fees tend to get higher due to the number of tax returns, complexity and the number of transactions involved. Typically, this is much less for a sole trader. There is no legal requirement to have an accountant file the self-assessment tax return, and some sole traders will file their own to save on costs. HMRC has filing software for self-assessment that is easy to use and free too.

- Limited Companies need to file more returns of a more complex nature, therefore accounting fees tend to be higher. A typical limited company would need:

- To file full statutory accounts with HMRC, including notes to the accounts. The format of these accounts is set in law.

- To file a full tax calculation with HMRC

- To file a set of filleted accounts with Companies House (a smaller set of numbers, and a different set of rules surrounding the format of these accounts)

- A self-assessment tax return for any Shareholders who have received dividends

- A payroll for the shareholders who want to ensure they utilise their personal allowance and/or have a qualifying year for state pension purposes

It is not a legal requirement to have an accountant file your accounts for limited companies either, however due to their complexity, it is rare that business owners do their own.

Insurances

Insurance premiums tend to be more for limited companies than for sole traders, even when the activities undertaken are exactly the same.

Interest on mortgages

If you are buying commercial properties or a buy to let portfolio through a limited company, you tend to find that the interest rate on the loan is slightly higher than if you buy as an individual. This can add up over time.

5 Badges of Professionalism

People make assumptions about other people all the time, and they do the same about our businesses too. They will rarely tell you they are judging you, or by what set of standards, but given that the first time someone buys from you, it is purely based on assumptions, then what can we do to improve people’s perception of our businesses.

1) Being a Limited Company or similar

a. If you are trading with individuals, B to C, then in the most part, these customers won’t notice your trading format. However, if you are trading with other limited companies, they may notice that you are not and make assumptions based on that.

Assumptions like:

i. You are very small

ii. You are not serious about what you do

b. People like the idea that you must report information about your business on Companies House.

2) VAT Registration

a. People in general are not aware that you can voluntarily register for VAT if you are making taxable supplies, or that you may choose to register voluntarily, so if you are VAT registered, most people will assume you turnover more than £90k p.a.

b. So, using this assumption, being VAT registered implies you are good at what you do, as lots of other people are already buying from you

c. It is not recommended that everyone registers for VAT, as for some businesses, this is most definitely NOT the right way to trade. Smaller businesses and individuals cannot reclaim the VAT you would charge, so this could have a negative impact on you getting work at the right margin.

3) Website

a. It is expected that all businesses will have a website, somewhere people can go to check you out, and also reviews to see what other people think about you

4) An email address which contains your business name

a. If your email address is @ yahoo or gmail etc, then it just doesn’t look professional. It isn’t expensive to get an email address with @your company name on it and it could have a huge impact on your business

5) Landline telephone number

a. People assume that if you have a landline telephone number then you have an office, or somewhere they can go to find you, if they need you!

b. You can pick up a landline telephone number online, and have it diverted to your mobile number if you are always out and about, or even employ the services of a virtual assistant who can answer the phone and take messages for you.

Articles

Mentoring Programme Set to Strengthen Local Business

The Mentoring for Growth Programme is designed to support small businesses across York and North Yorkshire that are ready to grow, scale, and move confidently into their next stage. The pilot will match local business owners and leaders with mentors from outside their industry, helping them to develop the core, non-technical skills that underpin sustainable business growth.

Strive Live Start-Up Incubator: Expression of Interest

Interested in joining a future cohort of Stive Live Start-Up Incubator? Find out more about the programme below, and register your interest to secure the first places when dates are confirmed.

Act now. 864,000 sole traders and landlords face new tax rules in two months

From 6 April 2026, those eligible will need to use recognised software to keep digital records and send HM Revenue and Customs (HMRC) light-touch quarterly updates of their income and expenses. These are not extra tax returns.

Events

03rd March 202611:00 am - 1:00 pmFREE

Online Workshops: Digital Marketing Success Series (Intermediate)

Join our Digital Marketing Success Series designed especially for small business owners who want to grow online, even if you don’t consider yourself “tech-savvy.” This weekly workshop series will guide you through the basics of digital marketing and on to more advanced strategies – all at your pace.

Resources

Webinar Series: Set Up for Success with Google Business Tools

This series explores the free tools available from Google to help small businesses increase their online presence. Plus, you’ll learn how to leverage Google’s paid advertising platform for scalable growth without feeling like you are just wasting money. Participants will leave feeling confident to start using Google Tools to Improve their visibility, generate leads and make more sales online.

Webinar Recording: PR for Small Businesses

Want to get your business featured in newspapers and magazines in 2026? In this webinar, Jo and Linda explain why you should be prioritising PR – including reaching a new audience (outside your social media bubble), building trust and credibility, and boosting your sales and SEO.

Webinar Recording: Automation & Efficiency Series

This webinar series provides a straightforward starting point to streamline and reduce day-to-day tasks, through automation and efficiency, across all areas of your business.