Business Essentials: What is a Tax Deductible Expense?

As a business owner, it can be daunting when you are trying to work out what you can and can’t claim as tax deductible expense. Other business owners will give you their opinion but is that the right advice for you and your business? You can search online, but this can be confusing and often contradictory. So, what can you claim?

The Wholly, Exclusively and Necessarily test

This is the overarching rule for all things tax deductible or not. Is the expense you are about to incur

Wholley and Exclusively – the sole purpose of incurring the expenditure is for the trade, profession or vocation of the business

Necessarily – and the business needed it to be incurred

Cost of Sale

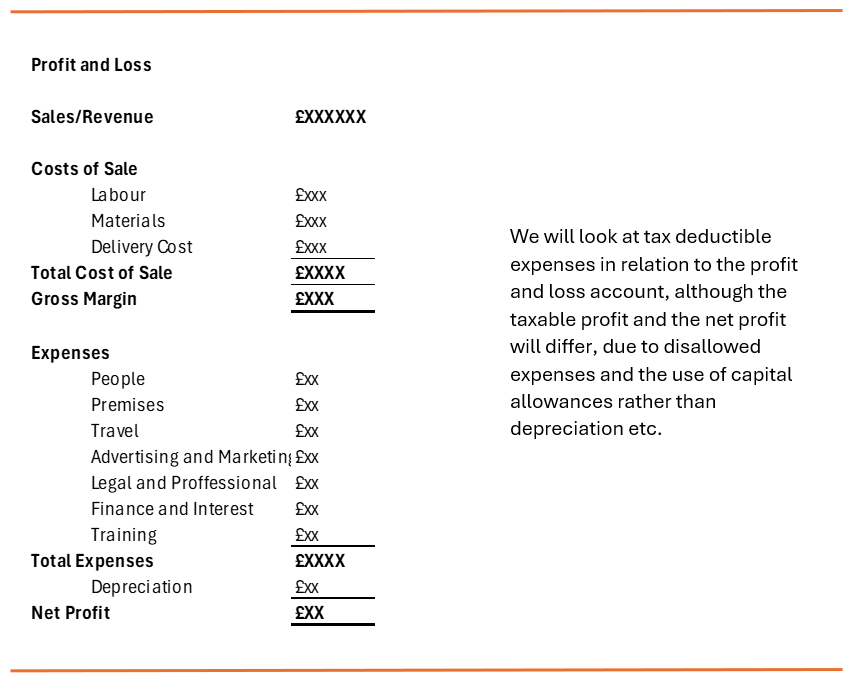

The first section of the profit and loss (P&L) account covers costs of sale. These are things that the company buys to sell and direct labour employed to either make or pack the things that the company sells.

This section can also have the labour involved in the provision of services. We will cover people costs later in this section.

Materials – The goods that we buy to sell or convert into finished goods via a manufacturing process of some kind are tax deductible. This includes those that we may use for display purposes, and samples (used to create content or marketing purposes of some kind).

We do need to watch out for any goods used for private use though. For example, if you have a café, it is unlikely that you would eat elsewhere during the time you are working, so you would need to account for this.

Stock – needs to be accounted for. If you have bought three tonnes of beans during the accounting period, but only sold one ton, then the other two tonnes are still in stock at the period end, and they would not be classed as tax deductible for that accounting period. They could be tax deductible expenses in a future accounting period though, once they have been sold/invoiced.

Delivery Costs are a cost of sale. If your customer expects their goods to be delivered, this cost will only be incurred when you sell the goods. You may charge for delivery and this revenue will appear in the sales section of the P&L, offsetting some or all of this cost, but sitting in a different part of the P&L.

People Costs

Pay – People costs via payroll. If you are employing people in your business, to facilitate the provision of the goods and services your business sells, then this cost is tax deductible and includes salaries, bonuses, employers national insurance contributions and employers pension contributions.

You may have people who work in your business, who are not paid via your payroll, like subcontractors, or agency workers. You would need a bill/receipt from these people/the agency for this to be a tax deductible expense for your business.

Training – If any training costs relate to the goods or services your business sells, then the costs for yourself and your team are tax deductible. You need to take care with training for something new. Re-training, or training for something the business doesn’t currently do, is not tax deductible. Remember the necessarily terminology we used at the start. This business, doing what this business does, doesn’t need training in something different. So, imagine I wanted to go into dog grooming, along with accounting. The course in dog grooming would not be a tax-deductible expense in my business. But the continual professional development we are required to do, is ongoing and to continue the provision of the services we already provide, so that is allowable.

Travel and travel related costs

You and your team may be required to travel as part of the work that you do. Tax deductible trips are those required by the business, so this doesn’t include home to work other than in some specific circumstances where there is a temporary place of work.

If the trip is a bona fide business trip, then the costs associated with it are allowable. So, things like bus, train or air fares, costs of taxi’s and parking. If the trip is made by a car or in a van, then we first need to look at who owns the vehicle.

Company owned, hired vehicles or vehicles leased in the company name

The tax treatment for the cost of a vehicle you purchase will depend on:

- If it’s a van or other commercial vehicle – This must be a highly specialised vehicle, or one with a payload of at least a tonne. A double cab pick-up used to be classified as a commercial vehicle, but the rules for this type of vehicle have recently changed. Going forward, double cab pick-ups will be classed as cars for tax purposes (transitional arrangements are currently in place if you already have one).

The cost is tax deductible. Allowances are available, making the whole cost of the vehicle tax deductible in the year of purchase, in most cases.

- A pool car – this must be kept at the premises of the business and be available for use by multiple persons.

The cost is tax deductible. Capital allowances are used to calculate how much of the purchase costs is deductible in any tax year. The percentage for the capital allowances calculation depends on when the car was purchased and its CO2 emissions.

- A non-pool car or van – a vehicle allocated to a particular employee. This would be tax deductible under the same rules as pool cars above, but there would also be a P11D benefit in kind tax on the employee that the vehicle was allocated to. The additional benefit in kind tax is charged as this vehicle can also be used for private use. The P11D benefit in kind is worked out using CO2 emissions for the vehicle and the fuel type. But company vans are capped at a benefit in kind for the use of the van of £3,960 in the 24/25 tax year, and £757 for fuel if fuel is also provided.

Running costs associated with vehicles owned by the business are also tax-deductible expenses. These include:

- Repairs and maintenance

- Servicing costs

- Insurance

- License fees

- Breakdown cover

- Fuel – if this is a non-pool car, then if you provide fuel, there may be a further P11D benefit in kind tax on the driver.

Personally owned, hired vehicles or vehicles leased in the company name

If you own or lease the vehicle personally that is being used for business trips, then you can charge the business for the use of your vehicle. You do this by logging mileage for any business trips you take and then charging these the business are the following rates:

- Cars or vans owned personally

- 45p per mile – for the first 10,000 miles in any tax year

- 25p per mile – for additional mileage over the first 10,000

- An additional 5p per mile is claimable if you carry a fellow employee in the car or van for a work journey

- Motor cycles – 24p per mile

- Bicycles – 20p per mile

Note – if you are a sole trader and you share the use of your vehicle between personal and business use, you can split the capital allowances for the purpose of the tax deductible charges.

Note – parking and speeding fines are not tax-deductible expenses.

Costs of Premises

Lots of businesses require premises to be able to trade. Offices, warehouses, manufacturing facilities, shops, hotels, bed and breakfast premises etc. If these premises are used wholly, exclusively and necessarily for the purpose of the business, then the costs associated with running them are tax deductible. Things like:

- Rent or mortgage interest

- Rates and water rates

- Utilities

- Insurances

- Phones and internet

- Printing, postage and stationery

- Software

- Security

Note – You can use your home as an office, and special rules apply to what you can claim for this.

Food and Drink

The rules around food and drink are not only about what, but where and in what circumstances the food or drink was consumed.

Travel and subsistence – this also covers the costs of traveling we have already discussed, and the costs of accommodation when an employee needs to stay away overnight.

Whilst away from the office on business, along with the cost of the travel and any overnight stay where appropriate, the following are allowable expenses:

- Meal costs

- Reasonable refreshments (both alcoholic and non-alcoholic) with a meal

- Refreshments, such as tea, coffee and soft drinks between meals

You can ask for receipts to support any expenses claims for travel and subsistence, but HMRC also have some scale rates that you can use to simplify the process if you wish.

- Breakfast rate £5 – where an employee leaves home earlier than normal and before 6am and incurs the cost of breakfast once the journey has started.

- Late evening meal rate £15 – when an employee has to work later than usual and will finish after 8pm and will have to buy a meal before the qualifying journey ends.

- One meal rate (5 hour) £5 – qualifying travel period of over 5 hours and the cost of a meal was incurred

- Two meal rate (10 hour) £10 – qualifying travel period of over 10 hours and the cost of a meal or meals was incurred

Staff Entertaining – Where you have a number of people on your payroll, as long as everyone is invited, and the total costs during the financial year does not exceed £150 per employee, then staff entertaining is allowable.

You must keep records of this, so that you can show HMRC that you didn’t go over the £150 per person per year. Records should include:

- Whether it was open to all employees

- How many events took place in the year

- The costs involved

- If any employees were also directors

Note – the £150 per person is not an allowance, and it includes VAT. If you exceed £150 per person per year, the whole cost is disallowed.

Office Refreshments – the provision of basic refreshments in the office is allowable. You can also claim the costs associated with a working lunch, whereby providing lunch there is no necessity to stop working.

Note – if lunch is provided in the office on a regular basis, then it is likely to form a P11D benefit in kind.

Client Entertaining – is not a tax-deductible expense. You can put it through as a business expense, but should identify it as client entertaining, and it will be disallowed in the tax calculation. This includes events where both clients and staff are present, as HMRC assumes that your team were there to host those who were not staff and therefore that the dominant purpose of the event was business entertaining.

Gifts

The £50 rule – Trivial Benefits. If you provide a gift to employees that has a value of less than £50 and cannot be exchanged for cash, then it falls under the trivial benefits rule and is a tax deductible expense that doesn’t impact P11D benefits in kind, as long as the gift is not linked to performance in any way, or be part of their contract.

If the employee is a director of a close company (run by 5 or fewer shareholders), then the number of times you can make these gifts in a financial year is a maximum of 6.

If the value of the gift is more than £50 or is linked to performance then this can trigger a P11D benefit in kind.

A bunch of flowers when its someone’s birthday or chocolates at Easter would be good examples of non-performance related gifts of less than £50.

Gifts to clients are not tax deductible. This is linked to client entertaining. However, if the gift is less than £50 in value, cannot be exchanged for cash, and incorporates a conspicuous advertisement of your business, then its allowable. The £50 is for the financial period, rather than each gift. The gift should not include tobacco, food, drink or exchangeable vouchers.

Gifts to charities – are tax deductible expenses, however. Unless your business is a sole trader format, in which case charitable donations do not qualify as tax deductible.

Staff Benefits – whilst these are tax deductible expenses for the business, they are also P11D benefits in kind on the employee receiving the benefit, unless you payroll the benefits (you need to agree this with HMRC upfront). This includes things like:

- Private medial

- Company cars

- Larger gifts and those related to performance

- Gym memberships

Note – If you reimburse professional memberships that are related to your business, then these do not create a P11D benefit in kind.

Note – you can provide eye tests for employees and glasses worn solely for use with computers at work without a P11D benefit in kind being activated.

Workwear

To qualify as being a tax deductible expense, workwear must be:

- Health and safety related, like safety books and hard hats

- Uniforms, including the company logo

- Other workwear with a prominent logo

Advertising and Marketing

These kinds of expenses are tax deductible and include things like:

- Direct costs of advertising and marketing

- Website costs

- Free samples

- Signage on premises or vehicle wrapping

- Networking – to promote your business and its services

Legal and Professional

If the costs are required by the business and not deemed to be capital expense related then they are tax deductible.

Some costs associated with buying and selling assets, would not be allowed as tax deductible at the point of purchase, but may be allowable as part of a capital gains tax calculation when the asset is sold.

- Accounting

- Bookkeeping

- Legal

- Insurances

Finance Charges

- Bank, overdraft and credit card charges

- Interest on business loans

- Hire purchase interest

- Leasing payment

Note – Finance costs associated with rental income are restricted to lower rate tax relief only on individuals. This does not apply to rental properties owned via a limited company.

Note – HMRC are not so keen of shared costs, so for example, increasing your mortgage to buy a buy to let property. How you apportion the costs associated with such shared costs is key.

Costs incurred before you started trading

You can claim some expenses incurred up to seven years prior to the date you started trading. These costs should be re-imbursed to the person who made the purchases and that person should be the owner/director or employee of the business.

These costs are treated as being incurred on the first day of trading.

The kinds of things you can claim are:

- Professional services, including accountancy fees and legal advice (within 6 months of starting trading)

- Domain names and hosting

- Computer equipment and office supplies

- Travel costs

- Premises costs

- Advertising, marketing and PR

Webinar: What is a Tax Deductible Expense?

What are the rules and exceptions to these rules when looking at whether expenses are tax deductible? Some of the rules can be complex and the exceptions to these rules don’t always appear to be logical. When? Tuesday 4 March – 10am to 11:30am Where? This is an online webinar, hosted on Zoom.

Business Essentials: What is a Tax Deductible Expense?

As a business owner, it can be daunting when you are trying to work out what you can and can’t claim as tax deductible expense. Other business owners will give you their opinion but is that the right advice for you and your business? You can search online, but this can be confusing and often contradictory. So, what can you claim?

How digital tax will benefit your business

You will probably have heard about digital tax but what does it actually mean for you and how will it benefit your business?