Scams warning as Self Assessment customers targeted

- HM Revenue and Customs (HMRC) is calling on Self Assessment customers to remain vigilant as scam attempts continue.

- Customers urged to be alert to bogus tax refund scams and phishing attempts.

- Report any suspicious emails, texts or calls to help stop fraudsters in their tracks.

Millions of Self Assessment customers are being urged by HM Revenue and Customs (HMRC) to remain vigilant to scams that claim to be from the department.

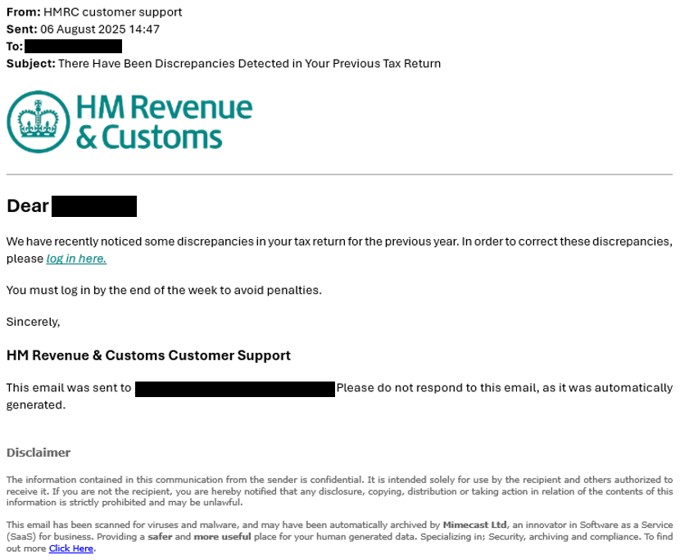

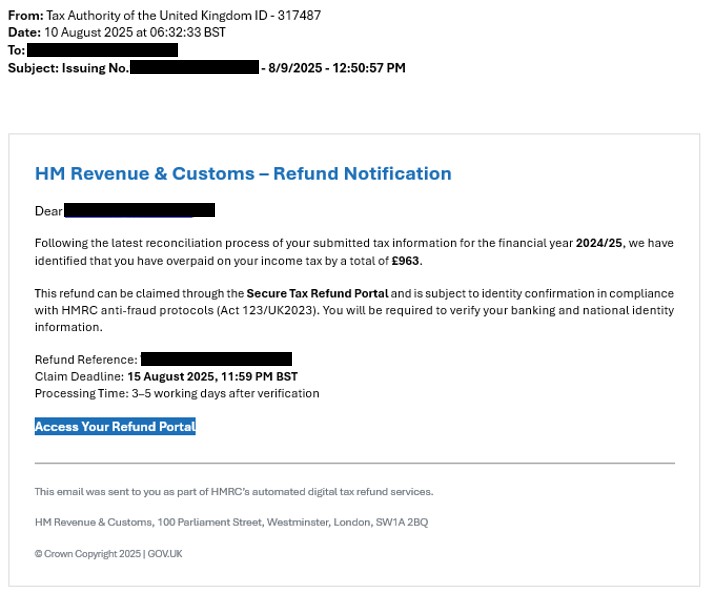

Scammers often impersonate HMRC, offering fake refunds or demanding urgent payments to steal personal and banking information. They may say it’s safe to share personal details. It’s not. Passwords, usernames, and access codes are private and customers should never share them, even with someone they trust or who helps them with their tax.

Filing early can also help customers spot scams more easily as those who have already submitted their tax return are less likely to be caught off guard by scam attempts closer to the Self Assessment 31 January 2026 deadline.

Concerned customers reported more than 170,000 scam referrals to HMRC in the 12 months to 31 July 2025 — and while that is a 12% reduction compared to the previous year, more than 47,000 of these reports still involved fake tax refund claims. If someone receives a communication claiming to be from HMRC that asks for personal details or offers a tax rebate, they should check the official HMRC scams guidance to verify its authenticity.

HMRC will never:

- leave voicemails threatening legal action or arrest

- ask for personal or financial information via text message or email

- contact customers by email, text, or phone to inform them about a refund or ask them to claim one. Anyone due a refund can claim it securely via their HMRC online account or via the free HMRC app.

Kelly Paterson, HMRC’s Chief Security Officer, said:

“Scammers target individuals when they know Self Assessment customers will be preparing to file their tax returns. We’re urging everyone to stay alert to scam emails and texts offering fake tax refunds.

“Taking a moment to pause and check can make all the difference. Report any suspicious activity to us before the fraudsters do any more harm. Search ‘HMRC scams advice’ and refer to the scams guidance on GOV.UK to stay informed and protect yourself.”

Customers can report phishing attempts to HMRC by:

- forwarding emails to phishing@hmrc.gov.uk

- reporting scam phone calls via GOV.UK

- forwarding suspicious texts to 60599

Scam examples:

Act now. 864,000 sole traders and landlords face new tax rules in two months

From 6 April 2026, those eligible will need to use recognised software to keep digital records and send HM Revenue and Customs (HMRC) light-touch quarterly updates of their income and expenses. These are not extra tax returns.

5.65 million still to file as the Self Assessment deadline looms

Customers can start their tax return, save it and re-visit it as many times as they need to before they submit it. And, once they’ve sent it, the bill doesn’t have to be paid straight away, but does need to be paid before the 31 January deadline. The easiest way to pay is through the HMRC app. Customers can also set up notifications in the app to ensure they know when payments are due so they don’t miss a deadline.

Self Assessment deadline is 100 days away

More than 3.5 million people have already filed their Self Assessment tax return for the 2024 to 2025 tax year and with 100 days to the 31 January 2026 deadline, HM Revenue and Customs (HMRC) is reminding those yet to file to do it early.

Scams warning as Self Assessment customers targeted

Scammers often impersonate HMRC, offering fake refunds or demanding urgent payments to steal personal and banking information. They may say it’s safe to share personal details. It’s not. Passwords, usernames, and access codes are private and customers should never share them, even with someone they trust or who helps them with their tax.

UK organisations stand to benefit from new data protection laws

The Data (Use and Access) Act 2025 (DUAA) has now received Royal Assent. This new legislation updates key aspects of data protection law, making it easier for UK businesses to protect people’s personal information while growing and innovating their products and services.

A record 299,419 returns filed in the first week of the new tax year

Self Assessment customers can submit their tax return for the 2024 to 2025 tax year between 6 April 2025, the first day of the new tax year, and the deadline on 31 January 2026.